Aging Population and Respiratory Disorders

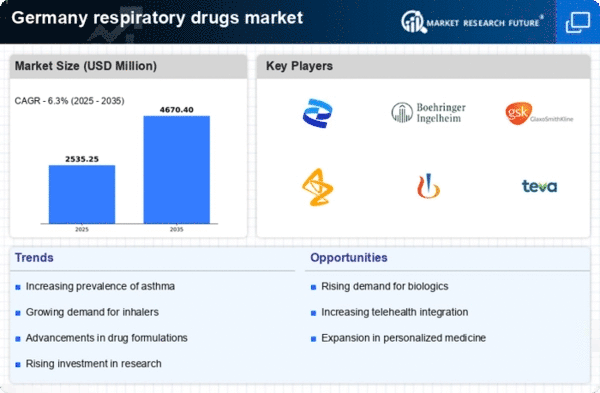

The aging population in Germany is a critical driver for the respiratory drugs market. As individuals age, the prevalence of respiratory disorders such as chronic obstructive pulmonary disease (COPD) and asthma tends to increase. According to recent statistics, approximately 10% of the German population is over 65 years old, a demographic that is particularly susceptible to respiratory ailments. This demographic shift is likely to escalate the demand for effective respiratory medications. Furthermore, the respiratory drugs market is projected to grow at a CAGR of around 5% over the next few years, driven by the need for innovative treatments tailored to older patients. The healthcare system in Germany is adapting to this trend by investing in research and development of new therapies, which may further enhance the market landscape.

Government Initiatives and Healthcare Policies

Government initiatives and healthcare policies play a crucial role in driving the respiratory drugs market. In Germany, the government has implemented various policies aimed at improving access to healthcare and promoting the development of new therapies. For instance, the introduction of reimbursement schemes for innovative respiratory medications is likely to enhance patient access to essential treatments. Additionally, the German healthcare system is known for its comprehensive coverage, which facilitates the availability of respiratory drugs to a broader population. As the government continues to prioritize respiratory health, the market is expected to benefit from increased funding for research and development. This supportive policy environment may foster innovation and lead to the introduction of new products, thereby stimulating growth in the respiratory drugs market.

Rising Air Pollution and Environmental Factors

Rising air pollution levels in urban areas of Germany are emerging as a significant driver for the respiratory drugs market. Studies indicate that air quality in cities like Berlin and Munich often falls below recommended standards, leading to increased incidences of respiratory diseases. The World Health Organization has reported that air pollution contributes to approximately 7% of respiratory-related deaths in Germany. This alarming statistic underscores the urgent need for effective respiratory treatments. Consequently, the respiratory drugs market is expected to expand as healthcare providers seek to address the growing burden of pollution-related respiratory conditions. The government may also implement stricter regulations on emissions, which could further influence the market dynamics by increasing the demand for therapeutic interventions.

Technological Advancements in Drug Delivery Systems

Technological advancements in drug delivery systems are significantly influencing the respiratory drugs market. Innovations such as nebulizers, inhalers, and smart devices are enhancing the efficacy of respiratory medications. For instance, the introduction of digital inhalers that track usage patterns is expected to improve patient adherence to prescribed therapies. In Germany, the market for inhalation devices is anticipated to reach €1 billion by 2026, reflecting a growing trend towards more efficient drug delivery methods. These advancements not only improve patient outcomes but also create opportunities for pharmaceutical companies to develop new products. As a result, the respiratory drugs market is likely to experience a surge in demand for these advanced delivery systems, which could reshape treatment protocols and patient management strategies.

Increased Awareness and Education on Respiratory Health

Increased awareness and education regarding respiratory health are pivotal in shaping the respiratory drugs market. Public health campaigns in Germany have focused on educating citizens about the risks associated with respiratory diseases and the importance of early diagnosis and treatment. This heightened awareness is likely to lead to more individuals seeking medical advice and treatment for respiratory conditions. As a result, the respiratory drugs market may witness a surge in demand for both prescription and over-the-counter medications. Furthermore, healthcare professionals are increasingly emphasizing the importance of managing respiratory health, which could lead to a more proactive approach among patients. This trend may ultimately contribute to a more robust market environment, as patients become more engaged in their treatment plans.