Impact of Environmental Factors

Environmental factors, including air pollution and allergens, are significantly influencing the respiratory drugs market. South Korea faces challenges related to air quality, with high levels of particulate matter and other pollutants contributing to respiratory issues. Studies indicate that poor air quality exacerbates conditions such as asthma and COPD, leading to increased medication usage. As the population becomes more aware of the health implications of environmental factors, there is a growing demand for effective respiratory treatments. This trend is likely to drive the respiratory drugs market, as healthcare providers and patients seek solutions to mitigate the effects of environmental triggers on respiratory health.

Advancements in Drug Formulations

Innovations in drug formulations are significantly influencing the respiratory drugs market. The development of novel inhalation devices and targeted delivery systems enhances the efficacy of respiratory medications. For instance, the introduction of dry powder inhalers and nebulizers has improved drug absorption and patient compliance. Additionally, the emergence of biologics and biosimilars offers new treatment options for patients with severe asthma and other respiratory conditions. These advancements not only improve therapeutic outcomes but also stimulate market growth by attracting investments in research and development. The South Korean pharmaceutical industry is increasingly focusing on creating advanced formulations that cater to the specific needs of patients, thereby driving the respiratory drugs market forward.

Rising Awareness of Respiratory Health

There is a growing awareness of respiratory health among the South Korean population, which is positively impacting the respiratory drugs market. Public health campaigns and educational initiatives have increased knowledge about the importance of managing respiratory conditions. This heightened awareness encourages individuals to seek medical advice and treatment, leading to an uptick in prescriptions for respiratory medications. Moreover, the rise of health-conscious consumers is driving demand for preventive measures and treatments. As more people recognize the significance of respiratory health, the market for respiratory drugs is expected to expand, fueled by the increasing number of patients seeking effective therapies.

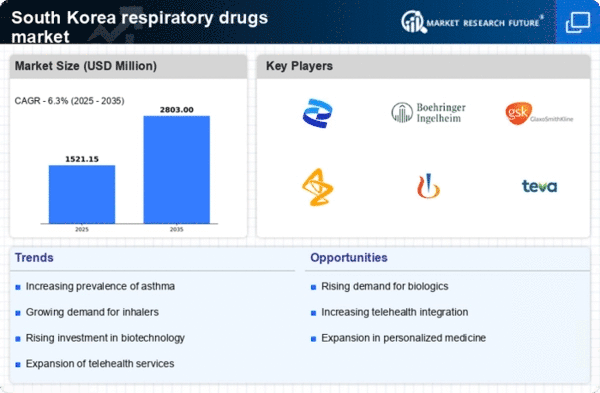

Growing Prevalence of Respiratory Diseases

The rising incidence of respiratory diseases in South Korea is a primary driver for the respiratory drugs market. Conditions such as asthma and chronic obstructive pulmonary disease (COPD) are becoming increasingly common, affecting a significant portion of the population. Recent statistics indicate that approximately 5.5 million individuals in South Korea suffer from asthma, while COPD prevalence is estimated at around 3.5 million. This growing patient base necessitates the development and availability of effective respiratory drugs, thereby propelling market growth. Furthermore, the aging population, which is more susceptible to respiratory ailments, contributes to the demand for innovative therapies. As healthcare providers focus on improving patient outcomes, the respiratory drugs market is likely to expand, driven by the need for effective management of these chronic conditions.

Government Initiatives and Healthcare Policies

Government initiatives aimed at improving respiratory health are playing a crucial role in shaping the respiratory drugs market. South Korea's healthcare policies emphasize the importance of managing chronic respiratory diseases through early diagnosis and effective treatment. The government has implemented various programs to promote awareness and education regarding respiratory health, which in turn drives demand for respiratory medications. Furthermore, funding for research and development in the pharmaceutical sector is increasing, leading to the introduction of new drugs and therapies. As a result, the respiratory drugs market is likely to benefit from these supportive policies, which aim to enhance healthcare access and improve patient outcomes.