Rising Awareness and Preventive Eye Care

There is a growing awareness among the Spanish population regarding the importance of eye health, which is driving the demand for ophthalmic drugs. Educational campaigns and community outreach programs have been instrumental in informing the public about the risks associated with untreated eye conditions. This heightened awareness is leading to increased consultations with ophthalmologists and, consequently, a rise in prescriptions for ophthalmic medications. Market analysis suggests that this trend is likely to continue, as more individuals seek preventive care and treatment options. The Spain ophthalmic drugs market stands to benefit from this shift towards proactive eye health management, as patients become more engaged in their healthcare decisions.

Advancements in Ophthalmic Drug Formulations

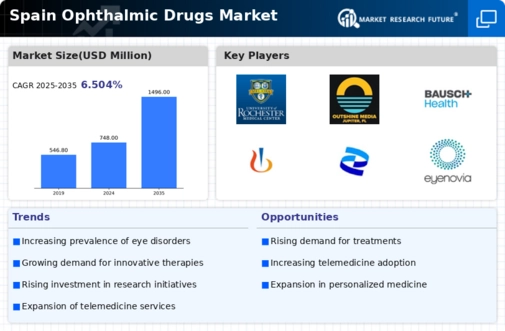

Innovations in drug formulations are significantly influencing the Spain ophthalmic drugs market. The development of sustained-release drug delivery systems and novel therapeutic agents is enhancing treatment efficacy and patient compliance. For instance, the introduction of injectable therapies for retinal diseases has shown promising results, leading to a surge in prescriptions. Market data indicates that the segment for innovative ophthalmic drugs is expected to grow at a compound annual growth rate (CAGR) of over 8% in the coming years. This trend suggests that pharmaceutical companies are increasingly investing in research and development to create advanced formulations that cater to the specific needs of patients, thereby driving the overall growth of the Spain ophthalmic drugs market.

Government Initiatives and Healthcare Policies

Government initiatives aimed at improving eye health are pivotal for the Spain ophthalmic drugs market. The Spanish government has implemented various healthcare policies that focus on enhancing access to eye care services and promoting awareness of eye diseases. For example, national screening programs for diabetic retinopathy have been established, which not only facilitate early diagnosis but also increase the demand for ophthalmic drugs. Additionally, funding for research into new treatments is being prioritized, which could lead to the introduction of novel therapies in the market. These initiatives indicate a supportive regulatory environment that is likely to foster growth in the Spain ophthalmic drugs market.

Integration of Telemedicine in Ophthalmic Care

The integration of telemedicine into ophthalmic care is emerging as a significant driver for the Spain ophthalmic drugs market. Telehealth services are facilitating remote consultations, which are particularly beneficial for patients in rural areas with limited access to eye care specialists. This trend has been accelerated by advancements in technology, allowing for effective monitoring and management of eye conditions. Data indicates that telemedicine consultations in ophthalmology have increased by over 50% in recent years. As patients become more comfortable with virtual healthcare, the demand for ophthalmic drugs is expected to rise, as prescriptions can be efficiently managed through these platforms. This shift towards digital health solutions may reshape the landscape of the Spain ophthalmic drugs market.

Aging Population and Increased Prevalence of Eye Disorders

The aging population in Spain is a critical driver for the ophthalmic drugs market. As the demographic shifts towards an older age group, the prevalence of age-related eye disorders, such as cataracts and macular degeneration, is expected to rise. According to recent statistics, approximately 30% of the Spanish population is projected to be over 65 by 2030, which correlates with a higher demand for ophthalmic treatments. This demographic trend suggests that the Spain ophthalmic drugs market will likely experience substantial growth as healthcare providers seek to address the increasing burden of eye diseases. Furthermore, the Spanish healthcare system is adapting to these changes by prioritizing funding for ophthalmic care, thereby enhancing access to innovative therapies and medications.