Investment in Research and Development

Investment in research and development (R&D) is a critical driver for the Spain molecular diagnostics transplant market. Both public and private sectors are increasingly allocating resources to advance molecular diagnostic technologies. In 2025, R&D spending in the Spanish healthcare sector reached approximately 1.5 billion euros, with a substantial portion directed towards molecular diagnostics. This investment is fostering collaborations between academic institutions, biotechnology firms, and healthcare providers, leading to the development of innovative diagnostic solutions. Furthermore, government initiatives aimed at promoting scientific research are likely to enhance the capabilities of the molecular diagnostics transplant market. As new diagnostic tools emerge from these R&D efforts, they are expected to improve patient outcomes and streamline transplant processes across Spain.

Increasing Prevalence of Chronic Diseases

The rising prevalence of chronic diseases in Spain is a significant driver for the molecular diagnostics transplant market. Conditions such as diabetes, hypertension, and autoimmune disorders are leading to an increased demand for organ transplants. According to the Spanish National Transplant Organization, the number of organ transplants has steadily increased, with over 5,000 transplants performed in 2025 alone. This growing demand necessitates advanced diagnostic tools to ensure compatibility and reduce the risk of transplant rejection. Molecular diagnostics play a crucial role in this process by providing detailed genetic information that aids in donor-recipient matching. As the population ages and the incidence of chronic diseases rises, the Spain molecular diagnostics transplant market is likely to expand to meet these evolving healthcare needs.

Rising Awareness of Personalized Medicine

There is a notable increase in awareness regarding personalized medicine within the Spain molecular diagnostics transplant market. Healthcare professionals and patients alike are recognizing the importance of tailored treatment approaches that consider individual genetic profiles. This shift towards personalized medicine is driving demand for molecular diagnostic tests that can provide insights into a patient's unique genetic makeup. In 2025, approximately 40% of transplant patients in Spain utilized molecular diagnostics to guide their treatment plans, reflecting a growing trend towards individualized care. The ability to customize immunosuppressive therapies based on genetic testing results is particularly significant in improving transplant success rates. As awareness continues to grow, the Spain molecular diagnostics transplant market is expected to see further advancements in personalized diagnostic solutions.

Regulatory Support for Innovative Diagnostics

The regulatory landscape in Spain is increasingly supportive of innovations in the molecular diagnostics transplant market. The Spanish Agency of Medicines and Medical Devices (AEMPS) has implemented streamlined approval processes for new diagnostic tests, which encourages the development and commercialization of cutting-edge technologies. This regulatory support is crucial, as it not only expedites the introduction of novel diagnostics but also ensures that they meet stringent safety and efficacy standards. In recent years, the AEMPS has approved several molecular diagnostic tests specifically designed for transplant patients, thereby enhancing the overall diagnostic capabilities within the market. This proactive regulatory environment is expected to foster further innovation and investment in the Spain molecular diagnostics transplant market, ultimately benefiting patients and healthcare providers alike.

Technological Advancements in Molecular Diagnostics

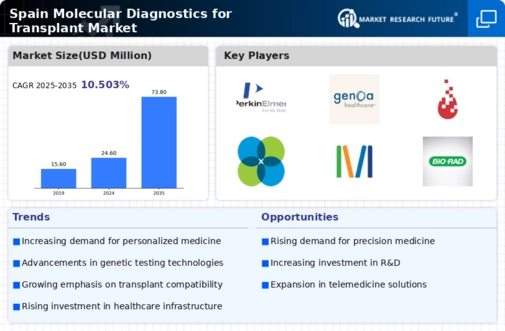

The Spain molecular diagnostics transplant market is experiencing a surge in technological advancements that enhance diagnostic accuracy and efficiency. Innovations such as next-generation sequencing (NGS) and polymerase chain reaction (PCR) techniques are becoming increasingly prevalent. These technologies allow for rapid and precise identification of genetic markers associated with transplant compatibility. In 2025, the market for molecular diagnostics in Spain was valued at approximately 300 million euros, reflecting a growing investment in advanced diagnostic tools. The integration of artificial intelligence in data analysis further streamlines the diagnostic process, potentially reducing the time required for test results. As these technologies continue to evolve, they are likely to play a pivotal role in improving patient outcomes and optimizing transplant procedures within the Spain molecular diagnostics transplant market.