Regulatory Framework and Support

The regulatory environment in the UK plays a crucial role in shaping the molecular diagnostics transplant market. The Medicines and Healthcare products Regulatory Agency (MHRA) has established guidelines that facilitate the approval and commercialization of innovative diagnostic tests. This supportive regulatory framework encourages research and development, enabling companies to bring new molecular diagnostic solutions to market more efficiently. Furthermore, the UK government has invested in initiatives aimed at promoting innovation in healthcare, including funding for research projects focused on transplant diagnostics. This regulatory support not only fosters a conducive environment for technological advancements but also enhances the overall competitiveness of the UK molecular diagnostics transplant market. As a result, stakeholders are more likely to invest in the development of novel diagnostic tools that can improve transplant success rates.

Rising Awareness of Genetic Testing

There is a growing awareness of the benefits of genetic testing within the UK molecular diagnostics transplant market. Patients and healthcare professionals are increasingly recognizing the value of genetic information in making informed decisions about organ transplantation. This heightened awareness is driving demand for molecular diagnostic tests that can assess transplant compatibility and predict potential complications. Educational campaigns and initiatives by healthcare organizations are contributing to this trend, as they emphasize the importance of genetic testing in improving transplant outcomes. As a result, the UK molecular diagnostics transplant market is likely to see an increase in the adoption of genetic testing services, which could lead to better patient management and enhanced success rates in organ transplantation.

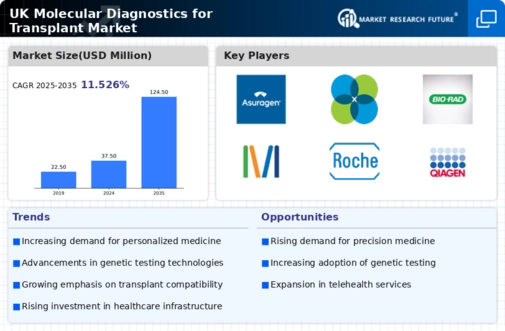

Growing Demand for Personalized Medicine

The shift towards personalized medicine is significantly influencing the UK molecular diagnostics transplant market. Healthcare providers are increasingly recognizing the importance of tailoring treatment plans to individual patient profiles, particularly in the context of organ transplantation. Molecular diagnostics play a pivotal role in this paradigm shift by enabling the identification of specific genetic markers that can inform treatment decisions. Recent studies indicate that personalized approaches to transplant medicine can lead to improved patient outcomes and reduced complications. As a result, the demand for molecular diagnostic tests that support personalized medicine is on the rise. This trend is expected to drive growth in the UK molecular diagnostics transplant market, as healthcare providers seek to implement more individualized treatment strategies that enhance the efficacy of transplant procedures.

Increased Investment in Research and Development

Investment in research and development (R&D) is a key driver of growth in the UK molecular diagnostics transplant market. Both public and private sectors are allocating substantial resources to advance the field of molecular diagnostics, particularly in relation to organ transplantation. The UK government has recognized the importance of R&D in healthcare and has committed to funding initiatives that support innovative diagnostic technologies. For instance, the UK Research and Innovation (UKRI) has launched several funding programs aimed at fostering collaboration between academia and industry. This influx of investment is likely to accelerate the development of novel molecular diagnostic tools that can enhance transplant success rates. Consequently, the UK molecular diagnostics transplant market stands to benefit from a robust pipeline of innovative solutions that address the evolving needs of healthcare providers and patients alike.

Technological Advancements in Molecular Diagnostics

The UK molecular diagnostics transplant market is experiencing rapid technological advancements that enhance the accuracy and efficiency of diagnostic tests. Innovations such as next-generation sequencing (NGS) and polymerase chain reaction (PCR) techniques are becoming increasingly prevalent. These technologies allow for the identification of genetic markers associated with transplant compatibility, thereby improving patient outcomes. According to recent data, the adoption of NGS in the UK has increased by approximately 30% over the past two years, indicating a growing reliance on advanced molecular diagnostics. This trend is likely to continue, as healthcare providers seek to leverage cutting-edge technologies to optimize transplant procedures and reduce the risk of rejection. As a result, the UK molecular diagnostics transplant market is poised for significant growth, driven by the demand for more precise and reliable diagnostic tools.