Regulatory Adaptations

The regulatory landscape surrounding the France molecular diagnostics transplant market is evolving to accommodate the rapid advancements in technology. The French government, through the National Agency for the Safety of Medicines and Health Products (ANSM), has implemented streamlined approval processes for molecular diagnostic tests. This regulatory flexibility aims to facilitate quicker access to innovative diagnostic tools for healthcare providers and patients. In 2025, the number of approved molecular diagnostic tests in France increased by 15%, reflecting the government's commitment to enhancing patient care. These adaptations not only promote the development of new diagnostic solutions but also ensure that existing tests meet stringent safety and efficacy standards. Consequently, the regulatory environment is a crucial driver for growth in the France molecular diagnostics transplant market, as it fosters innovation while safeguarding public health.

Rising Incidence of Chronic Diseases

The rising incidence of chronic diseases in France is a significant driver for the molecular diagnostics transplant market. Conditions such as diabetes and hypertension are leading to an increased need for organ transplants, thereby elevating the demand for effective diagnostic tools. In 2025, the French Ministry of Health reported a 10% increase in the number of organ transplants performed compared to the previous year, underscoring the growing need for molecular diagnostics to assess donor-recipient compatibility. This trend suggests that as chronic diseases become more prevalent, the reliance on molecular diagnostics to ensure successful transplant outcomes will intensify. Consequently, the France molecular diagnostics transplant market is likely to expand in response to the increasing demand for organ transplantation and the associated diagnostic requirements.

Increased Focus on Personalized Medicine

The shift towards personalized medicine is significantly influencing the France molecular diagnostics transplant market. Healthcare providers are increasingly recognizing the importance of tailoring treatment plans based on individual genetic profiles. This trend is particularly relevant in the context of organ transplantation, where genetic compatibility can greatly affect transplant success rates. In 2025, approximately 60% of transplant centers in France reported utilizing molecular diagnostics to inform their personalized treatment strategies. This growing emphasis on individualized care is likely to drive demand for advanced molecular diagnostic tools that can provide insights into patient-specific factors. As a result, the France molecular diagnostics transplant market is poised for growth, as stakeholders seek to enhance patient outcomes through personalized approaches.

Growing Investment in Research and Development

Investment in research and development (R&D) within the France molecular diagnostics transplant market is on the rise, driven by both public and private sectors. The French government has allocated substantial funding to support innovative research initiatives aimed at improving molecular diagnostic techniques. In 2025, R&D expenditures in the molecular diagnostics sector reached approximately 300 million euros, reflecting a 20% increase from the previous year. This influx of funding is fostering collaboration between academic institutions and industry players, leading to the development of novel diagnostic solutions. As R&D efforts continue to advance, the France molecular diagnostics transplant market is expected to benefit from the introduction of cutting-edge technologies that enhance diagnostic capabilities and improve patient care.

Technological Advancements in Molecular Diagnostics

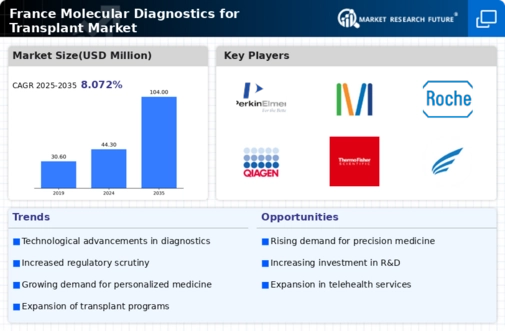

The France molecular diagnostics transplant market is experiencing a surge in technological advancements that enhance diagnostic accuracy and efficiency. Innovations such as next-generation sequencing (NGS) and polymerase chain reaction (PCR) techniques are becoming increasingly prevalent. These technologies enable the identification of genetic markers associated with transplant rejection, thereby improving patient outcomes. In 2025, the market for molecular diagnostics in France was valued at approximately 1.2 billion euros, reflecting a compound annual growth rate of 8% over the previous five years. This growth is indicative of the increasing reliance on molecular diagnostics to guide transplant decisions and monitor post-transplant complications. As healthcare providers adopt these advanced technologies, the France molecular diagnostics transplant market is likely to expand further, driven by the demand for precision medicine.