Government Initiatives and Funding

Government initiatives aimed at enhancing healthcare infrastructure significantly influence the japan molecular diagnostics transplant market. The Japanese government has been actively investing in research and development to promote innovative diagnostic technologies. For instance, the Health and Labour Ministry has allocated substantial funding to support projects that focus on molecular diagnostics for organ transplantation. This financial backing not only fosters innovation but also encourages collaboration between public institutions and private enterprises. Furthermore, the establishment of regulatory frameworks that facilitate the approval of new diagnostic tools is likely to expedite their entry into the market. Such initiatives are expected to bolster the adoption of molecular diagnostics, thereby improving the efficiency and effectiveness of transplant procedures across the nation.

Advancements in Genomic Technologies

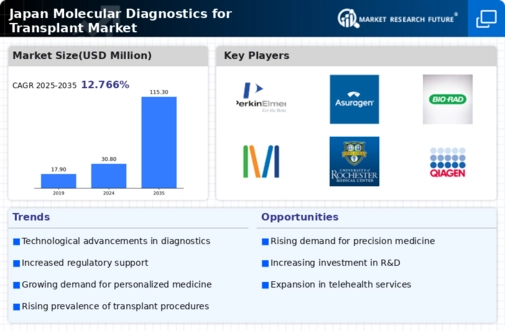

The rapid advancements in genomic technologies are reshaping the landscape of the japan molecular diagnostics transplant market. Innovations such as next-generation sequencing (NGS) and CRISPR-based techniques are enhancing the ability to analyze genetic material with unprecedented accuracy. These technologies enable healthcare providers to identify potential transplant recipients more effectively by assessing compatibility and predicting post-transplant outcomes. The market for genomic diagnostics is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 10% in the coming years. As these technologies become more accessible and affordable, their integration into transplant protocols is likely to improve patient stratification and personalized treatment approaches, ultimately leading to better transplant success rates.

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases in Japan is a pivotal driver for the japan molecular diagnostics transplant market. Conditions such as diabetes, cardiovascular diseases, and various cancers necessitate advanced diagnostic solutions for effective management and treatment. According to the Ministry of Health, Labour and Welfare, chronic diseases account for approximately 80% of healthcare expenditures in Japan. This growing burden on the healthcare system propels the demand for molecular diagnostics, which offer precise and timely information for transplant candidates. As the population ages, the need for organ transplants is expected to rise, further stimulating the market for molecular diagnostics tailored to transplant procedures. The integration of these diagnostics into clinical practice is likely to enhance patient outcomes and optimize resource allocation within the healthcare framework.

Growing Awareness of Precision Medicine

The increasing awareness and acceptance of precision medicine among healthcare professionals and patients are driving the japan molecular diagnostics transplant market. Precision medicine emphasizes tailored treatment strategies based on individual genetic profiles, which is particularly relevant in the context of organ transplantation. As patients become more informed about the benefits of molecular diagnostics, there is a corresponding rise in demand for these technologies. Educational campaigns and professional training programs are being implemented to enhance understanding of molecular diagnostics in transplant settings. This shift towards precision medicine is expected to lead to more informed decision-making regarding transplant eligibility and post-operative care, thereby improving overall patient outcomes and satisfaction.

Collaboration Between Academia and Industry

The collaboration between academic institutions and industry players is a crucial driver for the japan molecular diagnostics transplant market. Such partnerships facilitate the translation of research findings into practical applications, particularly in the field of molecular diagnostics. Universities and research organizations in Japan are increasingly engaging with biotechnology firms to develop innovative diagnostic tools that cater to the specific needs of transplant patients. This synergy not only accelerates the development of new technologies but also enhances the training of healthcare professionals in the latest diagnostic methodologies. As these collaborations expand, they are likely to yield breakthroughs that improve the accuracy and efficiency of transplant diagnostics, ultimately benefiting patients and healthcare providers alike.