Emergence of Biopharmaceuticals

The emergence of biopharmaceuticals in Spain is reshaping the landscape of the liquid chromatography-instruments market. As biopharmaceutical companies focus on developing complex biologics, the need for sophisticated analytical techniques becomes paramount. Liquid chromatography plays a crucial role in the characterization and quality assessment of biopharmaceutical products. The market is anticipated to witness a growth rate of 7% in this sector by 2025, driven by the increasing number of biopharmaceuticals entering the market. This trend suggests a promising future for liquid chromatography-instruments, as they become integral to the biopharmaceutical development process.

Rising Demand in Pharmaceutical Sector

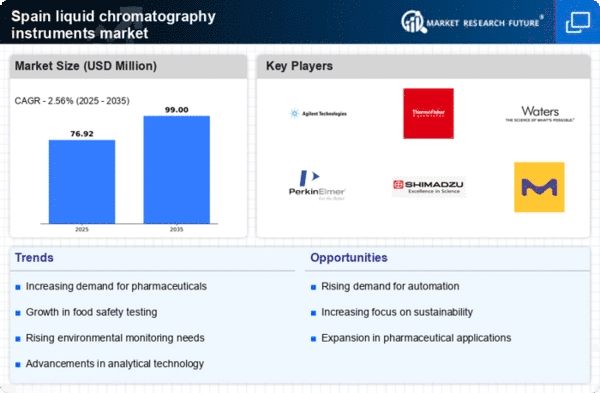

The pharmaceutical sector in Spain is experiencing a notable increase in demand for liquid chromatography-instruments. This growth is primarily driven by the need for precise analytical techniques in drug development and quality control. As pharmaceutical companies strive to meet stringent regulatory standards, the adoption of advanced liquid chromatography technologies becomes essential. In 2025, the market for liquid chromatography-instruments in the pharmaceutical industry is projected to reach approximately €200 million, reflecting a growth rate of around 8% annually. This trend indicates a robust investment in analytical capabilities, which is likely to bolster the liquid chromatography-instruments market.

Increased Focus on Environmental Testing

Environmental testing is gaining traction in Spain, leading to a heightened demand for liquid chromatography-instruments. Regulatory bodies are imposing stricter guidelines on environmental pollutants, necessitating accurate testing methods. Liquid chromatography is pivotal in analyzing contaminants in water, soil, and air samples. The liquid chromatography-instruments market is expected to benefit from this trend, with an estimated growth of 6% in the environmental sector by 2025. This focus on environmental safety and compliance is likely to drive innovation and investment in liquid chromatography technologies, enhancing their application across various industries.

Expansion of Academic Research Facilities

The expansion of academic research facilities in Spain is significantly impacting the liquid chromatography-instruments market. Universities and research institutions are increasingly investing in advanced analytical equipment to support scientific studies. This trend is expected to lead to a surge in demand for liquid chromatography-instruments, as researchers require reliable and efficient methods for sample analysis. By 2025, the academic sector is projected to account for approximately 15% of the total market share, reflecting a growing emphasis on research and development. This investment in academic infrastructure is likely to foster innovation and drive advancements in liquid chromatography technologies.

Technological Integration in Laboratories

The integration of advanced technologies in laboratories across Spain is influencing the liquid chromatography-instruments market. Automation and data management systems are increasingly being incorporated into laboratory workflows, enhancing efficiency and accuracy. This trend is likely to drive the adoption of liquid chromatography-instruments that are compatible with modern laboratory technologies. By 2025, it is estimated that around 30% of laboratories will have upgraded their analytical equipment to include automated liquid chromatography systems. This shift towards technological integration is expected to propel the liquid chromatography-instruments market, as laboratories seek to optimize their operations and improve analytical outcomes.