Increased Research Activities

France is witnessing a significant rise in research activities across various sectors, including biotechnology and environmental science. This increase is likely to drive the liquid chromatography-instruments market as researchers require sophisticated analytical tools for their experiments. The government has allocated substantial funding for research initiatives, which may lead to a projected growth of 10% in the market by 2026. The emphasis on innovation and development in research institutions suggests a sustained demand for liquid chromatography-instruments, as they play a crucial role in obtaining accurate and reliable data.

Emergence of Personalized Medicine

The concept of personalized medicine is gaining traction in France, leading to an increased demand for liquid chromatography-instruments. As healthcare providers focus on tailored treatment plans, the need for precise analytical methods to analyze patient-specific data becomes crucial. This shift is likely to drive the liquid chromatography-instruments market, with an anticipated growth rate of 9% over the next few years. The integration of liquid chromatography in clinical laboratories for biomarker discovery and drug testing suggests a promising future for the market, as it aligns with the evolving landscape of healthcare.

Rising Demand in Pharmaceutical Sector

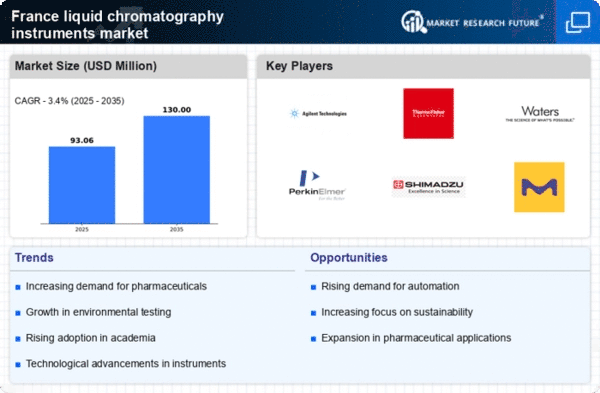

The pharmaceutical sector in France is experiencing a notable increase in demand for liquid chromatography-instruments. This surge is primarily driven by the need for precise analytical techniques in drug development and quality control. The liquid chromatography-instruments market is projected to grow as pharmaceutical companies invest in advanced technologies to ensure compliance with stringent regulations. In 2025, the market is expected to reach approximately €200 million, reflecting a growth rate of around 8% annually. This trend indicates that the pharmaceutical industry's reliance on liquid chromatography for effective analysis and formulation is likely to continue, thereby bolstering the market.

Focus on Quality Control in Food Industry

The food industry in France is placing greater emphasis on quality control and safety, which is likely to impact the liquid chromatography-instruments market positively. With rising consumer awareness regarding food safety, manufacturers are increasingly adopting liquid chromatography techniques to ensure compliance with health regulations. The market is expected to grow by approximately 7% annually as food producers invest in advanced analytical instruments. This trend indicates that the liquid chromatography-instruments market will play a vital role in maintaining food quality and safety standards, thereby enhancing consumer trust.

Technological Integration in Laboratories

The integration of advanced technologies in laboratories across France is expected to significantly influence the liquid chromatography-instruments market. Automation and data management systems are increasingly being adopted to enhance efficiency and accuracy in analytical processes. This trend may lead to a market growth of around 6% annually as laboratories seek to optimize their operations. The liquid chromatography-instruments market is likely to benefit from this technological evolution, as modern instruments equipped with innovative features can provide faster and more reliable results, catering to the growing demands of various industries.