Growing Academic Research Funding

The academic research landscape in South Korea is witnessing an increase in funding, which appears to be a key driver for the liquid chromatography-instruments market. With universities and research institutions receiving more financial support for scientific research, the demand for high-quality analytical instruments is likely to grow. In 2025, research funding in South Korea is projected to exceed $10 billion, with a significant portion allocated to life sciences and chemistry. This influx of funding is expected to enhance the capabilities of academic laboratories, leading to increased procurement of liquid chromatography instruments. As research initiatives expand, the liquid chromatography-instruments market is poised to benefit from this growing investment in academic research.

Expansion of Biotechnology Research

The biotechnology sector in South Korea is expanding rapidly, which appears to be a significant driver for the liquid chromatography-instruments market. With a focus on biopharmaceuticals and genetic research, the need for sophisticated analytical tools is becoming increasingly critical. The South Korean biotechnology market is anticipated to grow at a CAGR of around 10% over the next few years, leading to heightened demand for liquid chromatography instruments. These instruments are vital for the analysis of biomolecules, including proteins and nucleic acids, which are central to biotechnological research. As more institutions and companies invest in biotechnology, the liquid chromatography-instruments market is likely to benefit from this upward trend.

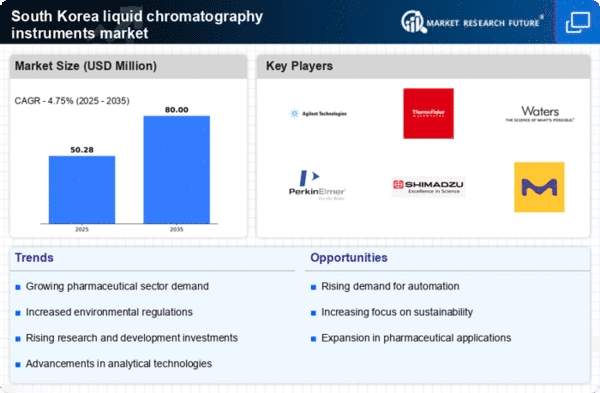

Rising Demand in Pharmaceutical Sector

The pharmaceutical sector in South Korea is experiencing a notable surge, which is likely to drive the liquid chromatography-instruments market. As the industry focuses on drug development and quality control, the need for precise analytical instruments becomes paramount. In 2025, the pharmaceutical market in South Korea is projected to reach approximately $30 billion, indicating a robust growth trajectory. This growth is expected to enhance the demand for liquid chromatography instruments, which are essential for analyzing drug compounds and ensuring compliance with stringent regulatory standards. Furthermore, the increasing investment in research and development within the pharmaceutical sector suggests a sustained demand for advanced analytical technologies, thereby positively impacting the liquid chromatography-instruments market.

Increased Focus on Environmental Testing

There is a growing emphasis on environmental testing in South Korea, which may significantly influence the liquid chromatography-instruments market. As environmental regulations become more stringent, industries are required to monitor pollutants and contaminants more rigorously. The demand for liquid chromatography instruments is expected to rise as they are essential for analyzing environmental samples, such as water and soil, for harmful substances. The South Korean government has allocated substantial funding towards environmental protection initiatives, which could further stimulate the market. In 2025, the environmental testing market is projected to grow by approximately 8%, indicating a robust opportunity for liquid chromatography-instruments to play a crucial role in ensuring compliance with environmental standards.

Technological Integration in Laboratories

The integration of advanced technologies in laboratories across South Korea is likely to propel the liquid chromatography-instruments market. Automation and digitalization are becoming increasingly prevalent, enhancing the efficiency and accuracy of laboratory processes. The adoption of smart laboratory technologies, including data management systems and automated liquid chromatography systems, is expected to grow significantly. This trend is supported by the South Korean government's initiatives to modernize laboratory infrastructure, which could lead to an estimated increase in laboratory spending by 15% by 2026. As laboratories seek to improve productivity and reduce operational costs, the demand for innovative liquid chromatography instruments is anticipated to rise, thereby benefiting the market.