Increasing Cybersecurity Threats

The rise in cybersecurity threats in Spain has become a pivotal driver for the lawful interception market. As cybercriminals employ increasingly sophisticated techniques, the demand for robust interception solutions has surged. Law enforcement agencies and telecommunications providers are compelled to enhance their capabilities to monitor and intercept communications effectively. In 2025, the Spanish government allocated approximately €50 million to bolster cybersecurity measures, which includes investments in lawful interception technologies. This funding reflects a growing recognition of the need for advanced tools to combat cyber threats, thereby propelling the lawful interception market forward. The urgency to protect sensitive data and maintain national security will likely drive investments in this sector.

Evolving Communication Technologies

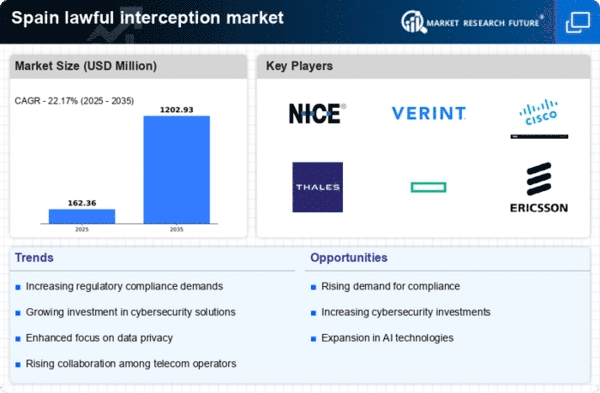

The rapid evolution of communication technologies in Spain significantly influences the lawful interception market. With the proliferation of mobile devices, VoIP services, and encrypted messaging applications, traditional interception methods are becoming less effective. As a result, telecommunications companies are increasingly seeking advanced lawful interception solutions that can adapt to these new technologies. The market is projected to grow at a CAGR of 12% from 2025 to 2030, driven by the need for solutions that can seamlessly integrate with emerging communication platforms. This evolution necessitates ongoing innovation within the lawful interception market, as stakeholders strive to keep pace with technological advancements and ensure compliance with legal requirements.

Growing Demand for Data Privacy Solutions

The increasing emphasis on data privacy in Spain is shaping the lawful interception market. As citizens become more aware of their rights regarding personal data, there is a growing demand for solutions that balance lawful interception with privacy concerns. The implementation of the General Data Protection Regulation (GDPR) has heightened scrutiny on how data is collected and processed. Consequently, lawful interception market players are focusing on developing technologies that ensure compliance with privacy regulations while still providing effective interception capabilities. This dual focus is likely to drive innovation and growth within the market, as stakeholders seek to address both security needs and privacy rights.

Legislative Changes and Compliance Requirements

In Spain, recent legislative changes have imposed stricter compliance requirements on telecommunications providers regarding lawful interception. The implementation of the European Electronic Communications Code mandates that service providers ensure their systems are capable of supporting lawful interception. This regulatory shift has created a pressing need for enhanced interception capabilities, thereby stimulating growth in the lawful interception market. Companies are investing in new technologies to meet these compliance standards, which are expected to increase operational costs by approximately 15% in the short term. As the legal landscape continues to evolve, the lawful interception market is likely to expand in response to these compliance pressures.

Public Safety and National Security Initiatives

Public safety and national security initiatives in Spain are driving the demand for lawful interception solutions. The government has prioritized the enhancement of surveillance capabilities to address rising concerns about terrorism and organized crime. In 2025, the Spanish Ministry of Interior announced a strategic plan to increase funding for surveillance technologies, including lawful interception systems, by 20%. This initiative aims to strengthen the country's ability to monitor potential threats and ensure the safety of its citizens. As a result, the lawful interception market is expected to experience significant growth, as both public and private sectors collaborate to develop and implement effective interception solutions.