Legislative Mandates

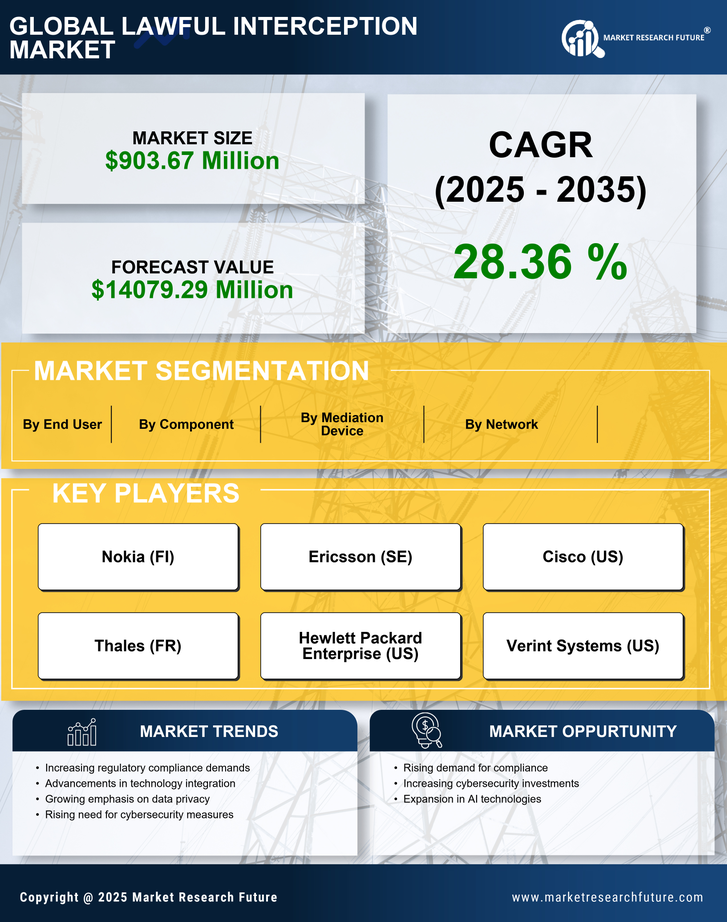

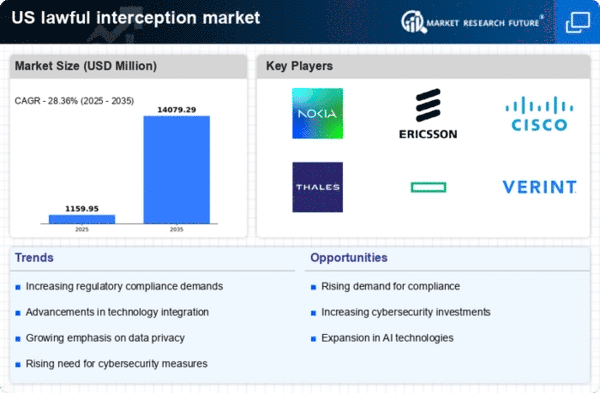

Legislative requirements play a crucial role in shaping the lawful interception market. In the US, various laws mandate telecommunications providers to implement interception capabilities to assist law enforcement agencies. The lawful interception market is influenced by these regulations, which necessitate compliance with specific technical standards and operational protocols. As of 2025, it is estimated that compliance-related expenditures will account for nearly 30% of the total market value. This regulatory landscape compels service providers to invest in advanced interception technologies, thereby driving market growth. The ongoing evolution of legislation, including updates to privacy laws, further impacts the lawful interception market, as companies must continuously adapt their systems to meet new legal requirements.

Public Safety Concerns

Public safety remains a paramount concern, driving the demand for lawful interception solutions. In the US, heightened awareness of security issues has led to increased scrutiny of communication channels. The lawful interception market is responding to this demand by providing tools that enable authorities to monitor communications for potential threats. As of 2025, it is projected that investments in public safety-related interception technologies will increase by approximately 20%. This trend underscores the necessity for effective surveillance systems that can assist in crime prevention and national security efforts. The growing emphasis on public safety is likely to propel the lawful interception market forward, as stakeholders seek to implement comprehensive monitoring solutions.

Technological Integration

The integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) is transforming the lawful interception market. These technologies enhance the capabilities of interception systems, allowing for more efficient data analysis and real-time monitoring. The lawful interception market is experiencing a shift towards solutions that leverage AI and ML to automate processes and improve accuracy in identifying relevant communications. By 2025, it is anticipated that AI-driven solutions will represent over 40% of the market, reflecting a significant trend towards automation in surveillance. This technological integration not only streamlines operations but also enables law enforcement agencies to respond more swiftly to potential threats, thereby reinforcing the importance of advanced interception technologies in the lawful interception market.

Evolving Cybersecurity Threats

The increasing sophistication of cyber threats is a primary driver for the lawful interception market. As cybercriminals develop more advanced techniques, organizations and government agencies are compelled to enhance their surveillance capabilities. The lawful interception market is witnessing a surge in demand for solutions that can effectively monitor and analyze communications to preemptively identify potential threats. In 2025, the market is projected to grow by approximately 15%, driven by the need for robust cybersecurity measures. This growth reflects a broader trend where entities prioritize the integration of advanced interception technologies to safeguard sensitive information and maintain national security. Consequently, the lawful interception market is adapting to these evolving threats, ensuring that interception solutions remain effective against emerging cyber risks.

Market Competition and Innovation

The competitive landscape of the lawful interception market is fostering innovation and driving advancements in technology. Numerous players are vying for market share, leading to the development of cutting-edge interception solutions. The lawful interception market is characterized by rapid technological advancements, with companies investing heavily in research and development to differentiate their offerings. By 2025, it is expected that the market will witness a 25% increase in new product launches, reflecting the dynamic nature of competition. This environment encourages continuous improvement in interception capabilities, ensuring that solutions remain effective in addressing the evolving needs of law enforcement and security agencies. As a result, the lawful interception market is likely to experience sustained growth fueled by innovation and competitive pressures.