Evolving Legal Frameworks

The legal landscape surrounding surveillance and data privacy in the GCC is evolving, prompting organizations to adapt their practices accordingly. New regulations and amendments to existing laws are being introduced to address the challenges posed by digital communication. This evolution creates a pressing need for lawful interception market solutions that comply with these legal requirements. As governments strive to balance privacy rights with security needs, the lawful interception market is likely to see increased demand for technologies that facilitate compliance while ensuring effective monitoring capabilities.

Rising Cybersecurity Concerns

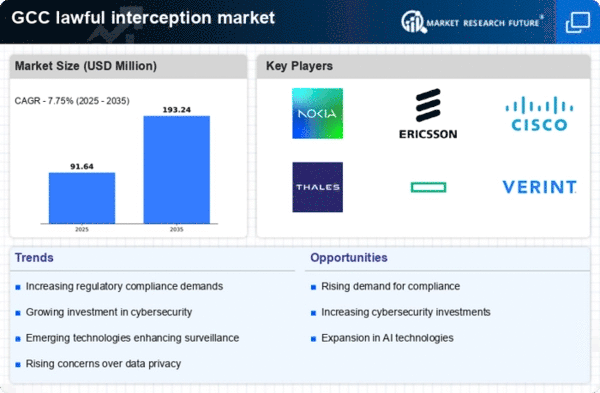

The increasing frequency of cyber threats and data breaches in the GCC region has heightened the demand for robust security measures. As organizations and governments face escalating risks, the lawful interception market is experiencing a surge in interest. This is particularly evident in sectors such as finance and telecommunications, where sensitive data is at stake. According to recent reports, the cybersecurity market in the GCC is projected to grow at a CAGR of 12% from 2025 to 2030. This growth is likely to drive investments in lawful interception technologies, as entities seek to enhance their surveillance capabilities to protect against cyber threats.

Telecommunications Sector Growth

The rapid expansion of the telecommunications sector in the GCC is a significant driver for the lawful interception market. With the proliferation of mobile devices and internet connectivity, the volume of data transmitted has increased exponentially. This growth presents both opportunities and challenges for law enforcement agencies, necessitating advanced interception technologies to monitor communications effectively. The telecommunications market in the GCC is anticipated to reach $50 billion by 2026, which may lead to increased investments in lawful interception systems to ensure compliance with regulatory requirements and enhance security measures.

Integration of AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning technologies into lawful interception systems is transforming the market landscape. These advanced technologies enable more efficient data analysis and real-time monitoring, enhancing the capabilities of law enforcement agencies. In the GCC, where the adoption of AI is on the rise, the lawful interception market is poised for growth. The market for AI in surveillance is projected to reach $2 billion by 2027, indicating a strong trend towards incorporating intelligent systems that can process vast amounts of data, thereby improving interception accuracy and effectiveness.

Government Initiatives for Surveillance

Governments in the GCC are increasingly prioritizing national security and public safety, leading to the implementation of various surveillance initiatives. These initiatives often necessitate the use of lawful interception technologies to monitor communications and gather intelligence. For instance, the UAE has established a comprehensive framework for electronic surveillance, which is expected to bolster the lawful interception market. The allocation of substantial budgets for security measures, estimated at over $5 billion in 2025, indicates a strong commitment to enhancing surveillance capabilities, thereby driving demand for lawful interception solutions.