Rising Demand for Public Safety

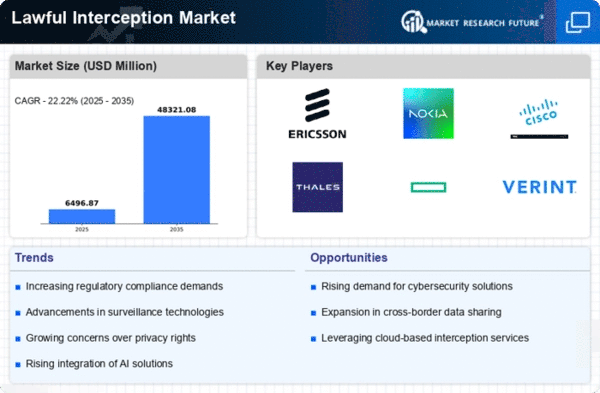

The Global Lawful Interception Market Industry is increasingly driven by the rising demand for public safety and crime prevention. Law enforcement agencies are under pressure to enhance their capabilities to respond to criminal activities effectively. This has led to a surge in investments in lawful interception technologies that enable timely access to critical information. For example, countries facing high crime rates are prioritizing the acquisition of interception tools to bolster their security infrastructure. This focus on public safety is likely to fuel market growth, with expectations of a significant increase in market size from 5.32 USD Billion in 2024 to 48.5 USD Billion by 2035.

Increasing Cybersecurity Concerns

The Global Lawful Interception Market Industry is experiencing heightened demand due to escalating cybersecurity threats. Governments and law enforcement agencies are increasingly investing in lawful interception technologies to combat cybercrime and terrorism. For instance, the rise in sophisticated hacking incidents has prompted regulatory bodies to enforce stringent compliance measures. This trend is reflected in the projected market growth from 5.32 USD Billion in 2024 to an anticipated 48.5 USD Billion by 2035, indicating a robust CAGR of 22.25% from 2025 to 2035. Such investments are essential for maintaining national security and public safety.

Regulatory Compliance Requirements

The Global Lawful Interception Market Industry is significantly influenced by stringent regulatory frameworks mandating lawful interception capabilities. Governments worldwide are implementing laws that require telecommunications and internet service providers to facilitate lawful interception for security agencies. For example, the European Union's ePrivacy Directive necessitates compliance from service providers, thereby driving demand for interception solutions. This regulatory landscape compels organizations to invest in advanced technologies to ensure compliance, contributing to the market's growth trajectory. As a result, the industry is poised for substantial expansion, aligning with the projected market valuation increase from 5.32 USD Billion in 2024 to 48.5 USD Billion by 2035.

Technological Advancements in Communication

The Global Lawful Interception Market Industry is propelled by rapid technological advancements in communication systems. The proliferation of mobile devices, VoIP, and encrypted messaging applications has necessitated the development of sophisticated interception solutions. As communication technologies evolve, so do the methods employed by law enforcement agencies to monitor and intercept communications legally. For instance, the integration of artificial intelligence and machine learning in interception technologies enhances the efficiency and effectiveness of surveillance operations. This trend is expected to contribute to the market's growth, with projections indicating a rise from 5.32 USD Billion in 2024 to 48.5 USD Billion by 2035.

Global Collaboration on Security Initiatives

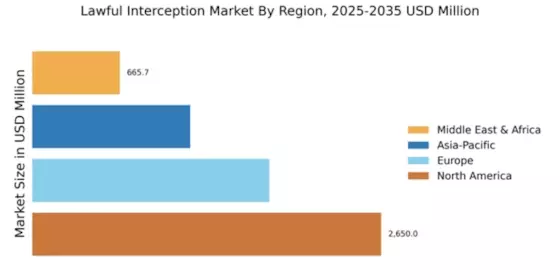

The Global Lawful Interception Market Industry is benefiting from increased global collaboration on security initiatives. International partnerships among nations to combat transnational crime and terrorism are fostering the exchange of intelligence and best practices in lawful interception. For instance, joint operations and information-sharing agreements among countries enhance the effectiveness of interception efforts. This collaborative approach not only strengthens national security but also drives demand for advanced interception technologies. As countries invest in these solutions, the market is expected to experience substantial growth, aligning with the projected increase from 5.32 USD Billion in 2024 to 48.5 USD Billion by 2035.