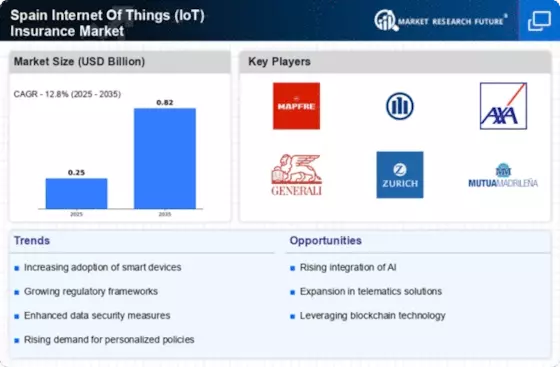

The Internet of Things (IoT) Insurance Market in Spain is going through some big changes because of new technologies and changing customer needs. More and more insurance policies are including IoT devices, which let them collect and monitor data in real time. The government is helping this change by pushing for digitalization and backing smart cities projects. Spanish insurance companies are using IoT technology to offer customized premiums depending on things like how people drive, the condition of their property, and other quantifiable behaviours. This makes sure that clients only pay for what they actually use.

This move toward usage-based models is interesting because it fits with what customers want: openness and freedom. Also, some important things that are driving the market include more connected devices, more people knowing about the benefits of IoT, and more cyber threats, which all make the demand for improved security and risk management solutions even higher. Spanish regulators are also starting to stress how important data privacy and security are. This is good news for insurance businesses who can offer strong cyber insurance policies.

As the need for personalized and complete coverage rises, IoT companies and traditional insurers could work together to produce new insurance solutions that are made just for the Spanish market.

Recently, there have been more startups and insurtech companies in the Spanish insurance business that focus on IoT applications in their products. This is another sign that insurance practices are becoming more modern. Overall, the combination of IoT technology and insurance services is likely to change how risks are evaluated, handled, and reduced in Spain, making the insurance market more efficient and focused on the needs of customers.

Spain Internet of Things IoT Insurance Market Drivers

Increasing Adoption of Smart Devices

The rising trend of smart device adoption in Spain significantly contributes to the growth of the Spain Internet of Things IoT Insurance Market Industry. According to data from the Spanish Government's National Statistics Institute, in 2022, the number of internet-connected devices in households in Spain reached over 30 million, marking a 25% increase compared to the previous year. This growing penetration of smart technologies creates more opportunities for insurance products tailored for IoT systems, appealing to both consumers and businesses.

As insurance companies like Mapfre and AXA expand their IoT insurance offerings, they are enhancing their business models to include coverage for smart home devices, vehicles, and connected health equipment. These developments indicate a vibrant market landscape that increasingly values IoT integration, attracting more investment in innovative insurance solutions.

Regulatory Support and Initiatives

For instance, with a focus on bolstering cybersecurity within IoT applications, the government encourages stakeholders to invest in IoT insurance solutions, promoting public-private collaborations. The alignment of regulatory frameworks with emerging technologies further boosts the confidence of established insurers like Zurich Seguros to develop IoT products tailored for Spanish consumers in response to market demand.

Rising Cybersecurity Concerns

The increasing threat of cyberattacks on connected devices has heightened the demand for IoT insurance coverage in Spain. Recent reports from Spain's National Cybersecurity Institute indicated a 40% rise in cyber incidents related to IoT technology over the past two years, underscoring the urgent need for businesses to protect their connected infrastructure. This situation creates a growing market for specialized insurance products that offer coverage for various IoT vulnerabilities.

Insurers such as Generali are expanding their cyber liability insurance offerings to incorporate IoT-related risks, recognizing the importance of safeguarding consumers and businesses from these looming threats. With a projected increase in IoT deployments, the need for comprehensive insurance and risk management solutions becomes even more critical.

Leave a Comment