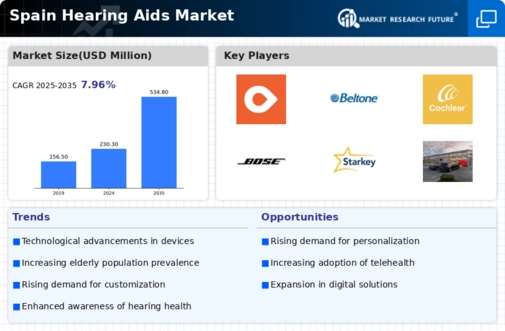

The hearing aids market in Spain is characterized by a competitive landscape that is increasingly shaped by innovation, strategic partnerships, and a focus on digital transformation. Key players such as Sonova Holding AG (CH), Amplifon S.p.A. (IT), and Demant A/S (DK) are actively pursuing strategies that enhance their market positioning. Sonova, for instance, emphasizes technological advancements in hearing solutions, while Amplifon focuses on expanding its retail presence and enhancing customer experience through digital channels. Demant, on the other hand, is investing in research and development to create more personalized hearing solutions, which collectively contribute to a dynamic competitive environment.

The business tactics employed by these companies include localizing manufacturing and optimizing supply chains to enhance efficiency and responsiveness to market demands. The competitive structure of the market appears moderately fragmented, with several players vying for market share. However, the influence of major companies is significant, as they set trends and standards that smaller firms often follow, thereby shaping the overall market dynamics.

In November 2025, Sonova Holding AG (CH) announced the launch of a new line of hearing aids that integrate artificial intelligence (AI) to provide users with a more tailored listening experience. This strategic move is likely to enhance user satisfaction and solidify Sonova's position as a leader in technological innovation within the market. The integration of AI not only improves sound quality but also personalizes the user experience, which is increasingly becoming a critical factor in consumer choice.

In December 2025, Amplifon S.p.A. (IT) expanded its partnership with a leading telehealth provider to offer remote audiology services. This initiative is indicative of a broader trend towards digital health solutions, allowing Amplifon to reach a wider audience and provide convenient services to customers. The strategic importance of this partnership lies in its potential to enhance customer engagement and streamline service delivery, which could lead to increased market penetration.

In January 2026, Demant A/S (DK) unveiled a new sustainability initiative aimed at reducing the environmental impact of its manufacturing processes. This initiative includes the use of recyclable materials in product design and a commitment to reducing carbon emissions by 30% by 2030. Such actions reflect a growing trend towards sustainability in the industry, which is becoming a key differentiator for consumers who are increasingly environmentally conscious.

As of January 2026, the competitive trends in the hearing aids market are heavily influenced by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are playing a crucial role in shaping the landscape, as companies seek to leverage each other's strengths to enhance their offerings. Moving forward, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, advanced technology, and reliable supply chains. This shift suggests that companies that prioritize these aspects will be better positioned to thrive in an increasingly competitive environment.