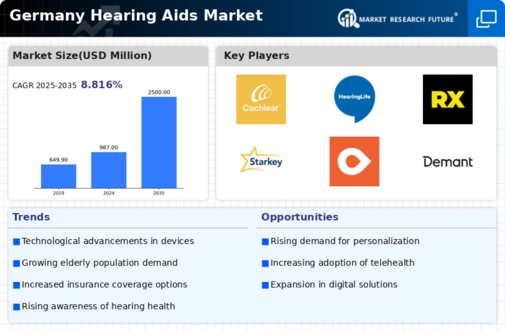

The hearing aids market in Germany is characterized by a competitive landscape that is both dynamic and multifaceted. Key growth drivers include an aging population, increasing awareness of hearing health, and advancements in technology. Major players such as Sonova Holding AG (CH), Demant A/S (DK), and WS Audiology A/S (DK) are strategically positioned to leverage these trends. Sonova, for instance, focuses on innovation and digital transformation, emphasizing the development of smart hearing aids that integrate seamlessly with consumer technology. Meanwhile, Demant has been expanding its product portfolio through strategic partnerships, enhancing its market presence. Collectively, these strategies contribute to a competitive environment that is increasingly defined by technological advancements and consumer-centric solutions.

In terms of business tactics, companies are localizing manufacturing and optimizing supply chains to enhance efficiency and responsiveness to market demands. The competitive structure of the market appears moderately fragmented, with several key players exerting influence. This fragmentation allows for a diverse range of products and services, catering to various consumer needs while fostering innovation through competition.

In November 2025, Sonova Holding AG (CH) announced a partnership with a leading tech firm to develop AI-driven hearing solutions. This collaboration is poised to enhance the user experience by providing personalized sound profiles, thereby addressing individual hearing needs more effectively. The strategic importance of this move lies in Sonova's commitment to integrating cutting-edge technology into its offerings, which may set a new standard in the industry.

In December 2025, Demant A/S (DK) launched a new line of hearing aids that feature advanced connectivity options, allowing users to connect seamlessly with smartphones and other devices. This initiative reflects Demant's focus on enhancing user engagement and accessibility, which could potentially attract a younger demographic. The strategic significance of this launch is underscored by the growing demand for multifunctional devices that cater to the tech-savvy consumer.

In January 2026, WS Audiology A/S (DK) unveiled a sustainability initiative aimed at reducing the environmental impact of its manufacturing processes. This initiative includes the use of recyclable materials and energy-efficient production methods. The strategic relevance of this move is twofold: it aligns with global sustainability trends and enhances WS Audiology's brand reputation among environmentally conscious consumers.

As of January 2026, current competitive trends in the hearing aids market are increasingly shaped by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, allowing companies to pool resources and expertise to drive innovation. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on technological innovation, enhanced user experience, and supply chain reliability. This shift may redefine market dynamics, compelling companies to prioritize R&D and sustainable practices to maintain a competitive edge.