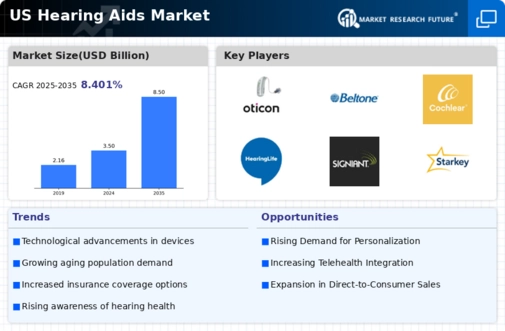

Aging Population

The aging population in the United States is a primary driver of the US hearing aids market. As the baby boomer generation continues to age, the prevalence of hearing loss is expected to rise significantly. According to the National Institute on Deafness and Other Communication Disorders, approximately 30 percent of adults aged 65 to 74 experience hearing loss, and this figure increases to 47 percent for those aged 75 and older. This demographic shift is likely to create a substantial demand for hearing aids, as older adults seek solutions to improve their quality of life. Furthermore, the US hearing aids market is projected to grow as more individuals recognize the importance of addressing hearing loss, leading to increased sales and innovation in hearing aid technology.

Telehealth Integration

The integration of telehealth services into the US hearing aids market is emerging as a transformative driver. Telehealth allows audiologists to provide remote consultations, fittings, and follow-up care, making hearing aid services more accessible to individuals in rural or underserved areas. This shift not only enhances convenience for consumers but also addresses the shortage of audiology professionals in certain regions. As telehealth becomes more widely accepted and utilized, the US hearing aids market is likely to see an increase in the number of individuals seeking hearing aids, thereby expanding the market and improving overall access to hearing health care.

Technological Innovations

Technological innovations play a crucial role in shaping the US hearing aids market. Recent advancements in digital technology have led to the development of more sophisticated hearing aids that offer enhanced sound quality, connectivity, and user-friendliness. Features such as Bluetooth connectivity, smartphone compatibility, and artificial intelligence integration are becoming increasingly common. These innovations not only improve the user experience but also attract a younger demographic who may not have previously considered hearing aids. The US hearing aids market is likely to benefit from these advancements, as they encourage more individuals to seek out hearing solutions, thereby expanding the overall market.

Increased Health Awareness

Increased health awareness among the US population is driving growth in the US hearing aids market. As individuals become more informed about the impacts of untreated hearing loss on overall health, including cognitive decline and social isolation, there is a growing recognition of the need for early intervention. Public health campaigns and educational initiatives are promoting the importance of regular hearing screenings, particularly for older adults. This heightened awareness is likely to lead to an increase in demand for hearing aids, as more individuals seek to address their hearing issues proactively. Consequently, the US hearing aids market is expected to see a rise in sales as awareness continues to grow.

Insurance Coverage Expansion

The expansion of insurance coverage for hearing aids is a significant driver of the US hearing aids market. Many states have begun to mandate insurance companies to provide coverage for hearing aids, which has historically been a barrier for many consumers. As more individuals gain access to financial assistance for hearing aids, the market is likely to experience increased demand. According to the Hearing Loss Association of America, only about 20 percent of people who could benefit from hearing aids actually use them, often due to cost. With improved insurance coverage, this percentage may rise, leading to a more robust US hearing aids market.