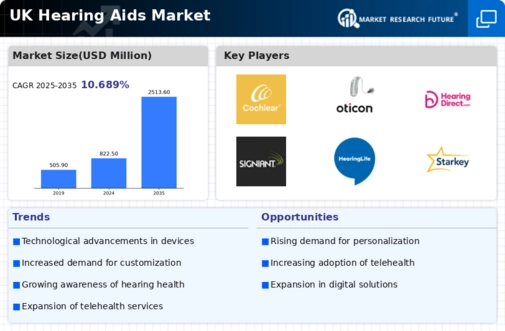

The UK hearing aids market is characterized by a competitive landscape that is increasingly shaped by innovation, technological advancements, and strategic partnerships. Key players such as Sonova Holding AG (CH), Demant A/S (DK), and WS Audiology A/S (DK) are at the forefront, each adopting distinct strategies to enhance their market presence. Sonova, for instance, emphasizes innovation through its extensive research and development initiatives, focusing on advanced hearing solutions that integrate digital technologies. Meanwhile, Demant has been actively pursuing mergers and acquisitions to bolster its product portfolio and expand its market reach, indicating a strategy aimed at consolidating its position in the market. WS Audiology, on the other hand, appears to be concentrating on regional expansion and enhancing customer engagement through digital platforms, which collectively shapes a competitive environment that is dynamic and multifaceted.

In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance efficiency and responsiveness to market demands. The competitive structure of the market is moderately fragmented, with several key players exerting influence over various segments. This fragmentation allows for a diverse range of products and services, catering to different consumer needs and preferences, while also fostering a competitive atmosphere that encourages innovation and differentiation.

In December 2025, Sonova Holding AG (CH) announced the launch of its latest hearing aid model, which incorporates artificial intelligence (AI) to enhance sound processing capabilities. This strategic move not only underscores Sonova's commitment to innovation but also positions the company to meet the growing consumer demand for technologically advanced hearing solutions. The integration of AI is likely to provide users with a more personalized hearing experience, thereby enhancing customer satisfaction and loyalty.

In November 2025, Demant A/S (DK) completed the acquisition of a regional hearing aid manufacturer, which is expected to strengthen its foothold in the UK market. This acquisition reflects Demant's strategy to expand its product offerings and leverage synergies in manufacturing and distribution. By integrating the acquired company's capabilities, Demant may enhance its operational efficiency and broaden its customer base, thereby reinforcing its competitive position.

In October 2025, WS Audiology A/S (DK) launched a new digital platform aimed at improving customer engagement and support. This initiative highlights the company's focus on digital transformation and its recognition of the importance of customer experience in the hearing aids market. By enhancing its digital presence, WS Audiology is likely to attract a broader audience and foster stronger relationships with existing customers, which could translate into increased market share.

As of January 2026, the competitive trends in the hearing aids market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances among key players are shaping the landscape, facilitating knowledge sharing and resource optimization. Looking ahead, competitive differentiation is expected to evolve, with a notable shift from price-based competition to a focus on innovation, technology, and supply chain reliability. This transition may lead to a more sustainable and customer-centric market, where companies that prioritize technological advancements and operational excellence are likely to thrive.