Adoption of Cloud Services

The shift towards cloud computing in Spain is reshaping the landscape of data security, thereby influencing the hardware security-modules market. As businesses migrate to cloud environments, the need for secure data storage and processing becomes paramount. Hardware security modules play a crucial role in protecting sensitive data in the cloud, offering encryption and secure key management. The market is anticipated to grow by 18% in the next few years, driven by the increasing reliance on cloud services across various sectors, including finance and healthcare. This trend indicates a growing recognition of the importance of integrating hardware security solutions to mitigate risks associated with cloud computing, thus propelling the hardware security-modules market forward.

Regulatory Pressures and Compliance

In Spain, regulatory frameworks such as the General Data Protection Regulation (GDPR) impose strict requirements on data handling and security. This regulatory environment is a significant driver for the hardware security-modules market, as organizations must implement effective security measures to avoid hefty fines and reputational damage. Compliance with these regulations often necessitates the deployment of hardware security modules to ensure data integrity and confidentiality. As organizations invest in compliance solutions, the hardware security-modules market is expected to expand, with an estimated growth rate of 12% annually. The increasing scrutiny from regulatory bodies further emphasizes the importance of adopting advanced security technologies, thereby reinforcing the market's growth trajectory.

Increasing Demand for Data Protection

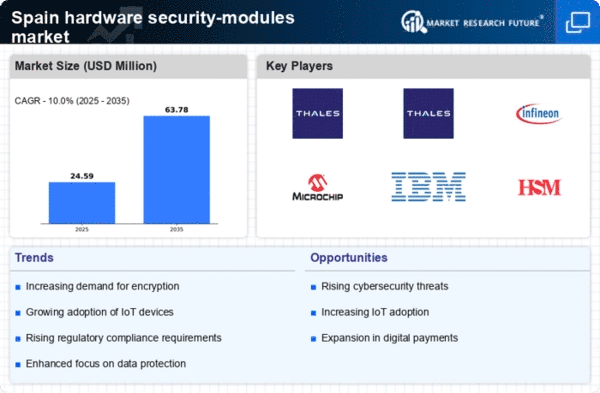

The growing concern over data breaches and cyber threats is driving the demand for robust security solutions in Spain. Organizations are increasingly recognizing the necessity of safeguarding sensitive information, which propels the hardware security-modules market. In 2025, the market is projected to reach a valuation of approximately €300 million, reflecting a compound annual growth rate (CAGR) of around 15% over the next five years. This surge is attributed to the rising number of cyberattacks targeting financial institutions and healthcare providers, necessitating advanced security measures. As businesses strive to comply with stringent data protection regulations, the hardware security-modules market is likely to experience substantial growth, as these modules provide essential encryption and secure key management capabilities.

Technological Innovations in Security Solutions

Technological advancements in security solutions are significantly impacting the hardware security-modules market in Spain. Innovations such as quantum cryptography and advanced encryption algorithms are enhancing the capabilities of hardware security modules, making them more effective against evolving cyber threats. As organizations seek to adopt cutting-edge technologies to protect their assets, the demand for these advanced security solutions is likely to increase. The market is projected to grow at a rate of 14% annually, driven by the need for more sophisticated security measures. This trend suggests that as technology evolves, so too will the hardware security-modules market, adapting to meet the challenges posed by increasingly sophisticated cyber threats.

Rising Investment in Cybersecurity Infrastructure

The increasing allocation of resources towards cybersecurity infrastructure in Spain is a pivotal driver for the hardware security-modules market. Organizations are recognizing the necessity of investing in comprehensive security frameworks to protect against potential threats. In 2025, it is estimated that spending on cybersecurity will exceed €5 billion, with a significant portion directed towards hardware security solutions. This trend indicates a growing commitment to enhancing security postures, as businesses aim to safeguard their operations and customer data. The hardware security-modules market is likely to benefit from this investment surge, as organizations prioritize the implementation of robust security measures to mitigate risks associated with cyberattacks.