Growing Adoption of IoT Devices

The proliferation of Internet of Things (IoT) devices is significantly influencing the hardware security-modules market. As more devices become interconnected, the potential attack surface for cyber threats expands, necessitating enhanced security measures. In 2025, the number of connected IoT devices is projected to reach 30 billion in the US alone. This surge in IoT adoption drives demand for hardware security modules, which provide essential encryption and authentication capabilities. The hardware security-modules market is thus likely to see increased investments as organizations strive to secure their IoT ecosystems against vulnerabilities and attacks.

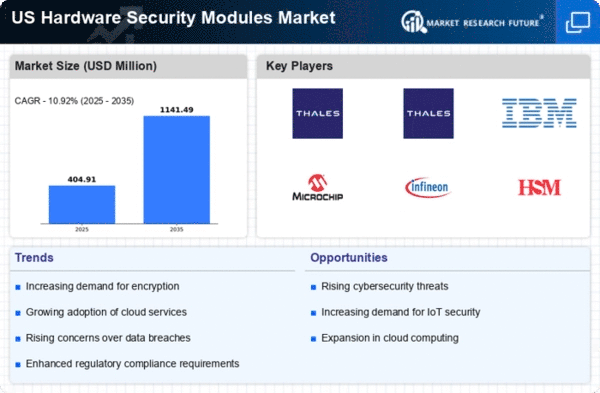

Increasing Cybersecurity Threats

The hardware security-modules market is experiencing growth due to the escalating frequency and sophistication of cyber threats. Organizations are increasingly recognizing the necessity for robust security measures to protect sensitive data. In 2025, it is estimated that cybercrime could cost businesses globally over $10 trillion annually. This alarming trend compels companies to invest in hardware security modules as a means to safeguard their digital assets. The hardware security-modules market is thus positioned to benefit from this heightened awareness and urgency surrounding cybersecurity, as businesses seek to mitigate risks associated with data breaches and unauthorized access.

Demand for Secure Payment Solutions

The hardware security-modules market is benefiting from the increasing demand for secure payment solutions. With the rise of digital transactions and e-commerce, businesses are prioritizing the protection of payment information to prevent fraud and data breaches. In 2025, it is anticipated that the digital payment market in the US will exceed $1 trillion. This growth creates a pressing need for hardware security modules, which facilitate secure payment processing through encryption and secure key management. The hardware security-modules market is thus likely to expand as financial institutions and retailers invest in advanced security technologies to protect consumer data.

Regulatory Pressures for Data Protection

The hardware security-modules market is being propelled by stringent regulatory requirements aimed at protecting sensitive data. In the US, regulations such as the California Consumer Privacy Act (CCPA) and the Health Insurance Portability and Accountability Act (HIPAA) mandate organizations to implement robust security measures. Compliance with these regulations often necessitates the deployment of hardware security modules to ensure data integrity and confidentiality. As organizations strive to meet these legal obligations, the hardware security-modules market is expected to witness substantial growth, driven by the need for compliance and risk management.

Advancements in Cryptographic Technologies

The hardware security-modules market is being driven by ongoing advancements in cryptographic technologies. As encryption becomes increasingly vital for securing data, organizations are turning to hardware security modules to implement sophisticated cryptographic algorithms. In 2025, the market for cryptographic solutions is projected to grow at a CAGR of over 15%. This trend indicates a strong demand for hardware security modules that can support advanced encryption standards and provide secure key management. The hardware security-modules market is poised for growth as businesses seek to enhance their security posture through cutting-edge cryptographic solutions.