Emergence of IoT Devices

The proliferation of Internet of Things (IoT) devices in China is creating new challenges and opportunities for the hardware security-modules market. With millions of connected devices generating vast amounts of data, the need for secure communication and data integrity is more critical than ever. Hardware security modules provide essential encryption and authentication capabilities, ensuring that IoT devices can operate securely. As the number of IoT devices is projected to exceed 1 billion by 2025, the hardware security-modules market is likely to experience substantial growth. This trend underscores the necessity for robust security solutions to protect against potential vulnerabilities associated with the expanding IoT ecosystem.

Rising Adoption of Cloud Services

The shift towards cloud computing in China is a pivotal driver for the hardware security-modules market. As businesses migrate their operations to the cloud, the need for secure data storage and processing becomes paramount. Hardware security modules play a crucial role in ensuring that data remains protected in cloud environments. In 2025, it is estimated that the cloud services market in China will reach approximately $100 billion, further amplifying the demand for hardware security solutions. This trend indicates that organizations are prioritizing security measures to protect their cloud-based assets, thereby propelling the hardware security-modules market forward as companies seek to comply with stringent security standards.

Government Initiatives and Support

The hardware security-modules market in China is significantly influenced by government initiatives aimed at enhancing cybersecurity infrastructure. The Chinese government has implemented various policies and funding programs to promote the development and adoption of advanced security technologies. For instance, the National Cybersecurity Strategy emphasizes the importance of securing critical information infrastructure, which includes the deployment of hardware security modules. This governmental backing not only fosters innovation but also encourages enterprises to invest in security solutions. As a result, the hardware security-modules market is likely to see increased growth, with public sector projects driving demand for secure data management and encryption solutions.

Increasing Demand for Data Protection

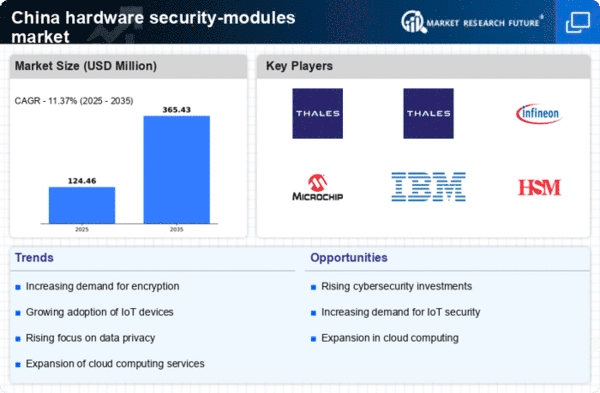

The hardware security-modules market in China is experiencing a notable surge in demand for data protection solutions. As organizations increasingly recognize the importance of safeguarding sensitive information, the adoption of hardware security modules has become a strategic priority. In 2025, the market is projected to grow at a CAGR of approximately 15%, driven by the need to secure data against unauthorized access and cyber threats. This trend is particularly pronounced in sectors such as finance and healthcare, where data breaches can have severe consequences. Consequently, the hardware security-modules market will benefit from this heightened focus on data integrity and confidentiality., as businesses seek robust solutions to mitigate risks associated with data loss and theft.

Growing Awareness of Compliance Requirements

In China, the increasing awareness of compliance requirements is driving the hardware security-modules market. Organizations are becoming more cognizant of the need to adhere to various regulations related to data protection and privacy. Compliance with laws such as the Cybersecurity Law and the Personal Information Protection Law necessitates the implementation of stringent security measures, including the use of hardware security modules. As companies strive to meet these regulatory demands, the hardware security-modules market is expected to expand. This trend highlights the critical role that compliance plays in shaping security investments, as businesses seek to avoid penalties and enhance their reputations through responsible data management practices.