Expansion of IoT Devices

The proliferation of Internet of Things (IoT) devices is a key driver for the hardware security-modules market. As more devices become interconnected, the potential for security vulnerabilities increases, prompting the need for enhanced protection measures. In the UK, it is estimated that the number of IoT devices will reach 1 billion by 2025. This rapid expansion necessitates the integration of hardware security modules to secure data transmission and device authentication. Consequently, the hardware security-modules market is likely to see significant growth as organisations seek to implement robust security solutions to mitigate risks associated with IoT deployments.

Rising Cybersecurity Threats

The hardware security-modules market is experiencing growth due to the increasing frequency and sophistication of cyber threats. As organisations in the UK face heightened risks from data breaches and cyberattacks, the demand for robust security solutions is paramount. In 2025, it is estimated that cybercrime could cost the UK economy over £50 billion annually. This alarming trend compels businesses to invest in hardware security modules to safeguard sensitive information and maintain customer trust. The hardware security-modules market is thus positioned to benefit from this urgent need for enhanced security measures, as companies seek to protect their digital assets against evolving threats.

Growing Demand for Data Privacy

In the context of the hardware security-modules market, the increasing emphasis on data privacy regulations is a significant driver. The UK has implemented stringent data protection laws, such as the Data Protection Act 2018, which align with the EU's GDPR. These regulations mandate that organisations take necessary measures to protect personal data, leading to a surge in the adoption of hardware security modules. By 2025, it is projected that compliance-related investments in security technologies could reach £7 billion in the UK. Consequently, businesses are likely to turn to hardware security modules as a means to ensure compliance and protect sensitive data, thereby fuelling market growth.

Increased Investment in Fintech Solutions

The hardware security-modules market is benefiting from the surge in investment in fintech solutions across the UK. As financial institutions and startups seek to innovate and enhance their service offerings, the need for secure transaction processing becomes essential. In 2025, the UK fintech sector is projected to attract over £4 billion in investments, creating a substantial demand for hardware security modules to ensure secure financial transactions. This trend indicates that as fintech companies expand their operations, they are likely to adopt hardware security modules to protect customer data and maintain regulatory compliance, thus driving market growth.

Advancements in Cryptographic Technologies

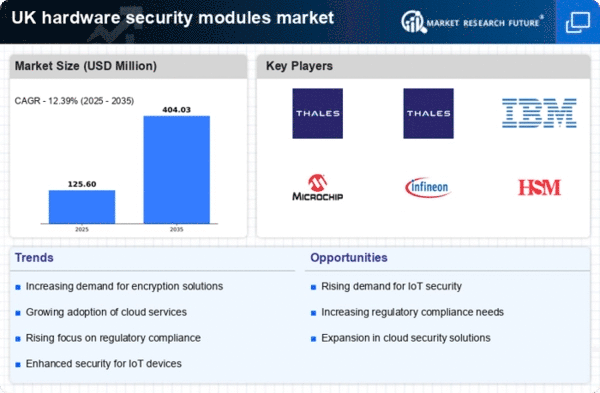

The hardware security-modules market is being propelled by rapid advancements in cryptographic technologies. Innovations in encryption methods and key management are enhancing the capabilities of hardware security modules, making them more effective in protecting sensitive information. As organisations in the UK increasingly rely on digital transactions and cloud services, the need for advanced cryptographic solutions becomes critical. The market for cryptographic hardware is expected to grow at a CAGR of 12% from 2025 to 2030. This growth indicates a strong demand for hardware security modules that can support these advanced technologies, thereby driving the overall market forward.