Integration of Telemedicine

The integration of telemedicine into the healthcare system in Spain is emerging as a pivotal driver for the Epilepsy Devices Market. Telemedicine facilitates remote consultations and monitoring, which is particularly advantageous for patients living in remote or underserved areas. This trend is likely to enhance access to specialized care for individuals with epilepsy, thereby increasing the demand for devices that support telehealth functionalities. The Spanish government has been actively promoting telemedicine initiatives, especially in the wake of the growing need for accessible healthcare solutions. As telemedicine continues to gain traction, the Spain Epilepsy Devices Market is expected to expand, with a focus on devices that can seamlessly integrate with telehealth platforms, ultimately improving patient outcomes and satisfaction.

Rising Prevalence of Epilepsy

The prevalence of epilepsy in Spain is a significant driver for the Epilepsy Devices Market. Current estimates suggest that approximately 0.7% of the Spanish population is affected by epilepsy, translating to around 300,000 individuals. This rising prevalence necessitates the development and adoption of effective management devices. The increasing number of diagnosed cases is prompting healthcare providers to seek advanced solutions that can improve patient quality of life. Furthermore, the Spanish government has recognized the need for enhanced epilepsy care, leading to increased funding for research and development in this area. As a result, the market is likely to see a surge in demand for innovative devices that address the specific needs of the growing patient population.

Regulatory Support and Standards

The regulatory landscape in Spain plays a crucial role in shaping the Epilepsy Devices Market. The Spanish Agency of Medicines and Medical Devices (AEMPS) has established stringent guidelines that ensure the safety and efficacy of epilepsy devices. This regulatory support not only instills confidence among manufacturers but also encourages innovation within the industry. The recent updates to the Medical Device Regulation (MDR) in the European Union have further streamlined the approval process for new devices, making it easier for companies to bring their products to market. As a result, the Spain Epilepsy Devices Market is likely to witness an influx of new technologies that comply with these regulations, ultimately benefiting patients and healthcare providers alike.

Increased Awareness and Education

In recent years, there has been a marked increase in awareness and education regarding epilepsy in Spain. Various organizations and healthcare institutions are actively promoting epilepsy awareness campaigns, which have led to a better understanding of the condition among the general public. This heightened awareness is crucial for the Spain Epilepsy Devices Market, as it encourages patients to seek treatment and explore available device options. Additionally, educational initiatives aimed at healthcare professionals are improving the diagnosis and management of epilepsy, thereby increasing the demand for advanced devices. As more individuals become informed about their treatment options, the market is expected to expand, with a growing emphasis on innovative solutions that cater to the needs of patients.

Technological Advancements in Devices

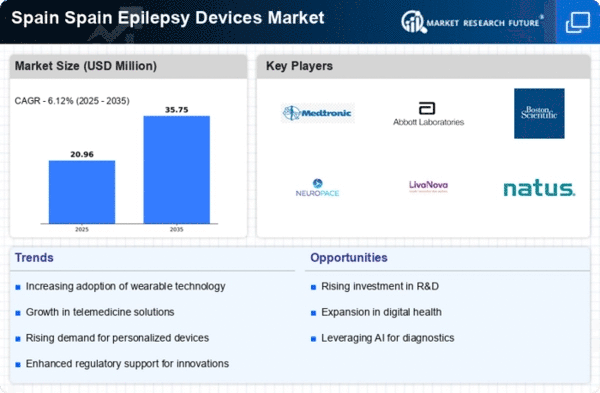

The Spain Epilepsy Devices Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as wearable devices, implantable neurostimulators, and advanced monitoring systems are enhancing the management of epilepsy. For instance, the integration of artificial intelligence in seizure prediction algorithms is becoming increasingly prevalent. These technologies not only improve patient outcomes but also facilitate remote monitoring, which is particularly beneficial in rural areas of Spain. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years, driven by these advancements. Furthermore, the collaboration between tech companies and healthcare providers is likely to foster the development of more sophisticated devices tailored to the needs of Spanish patients.