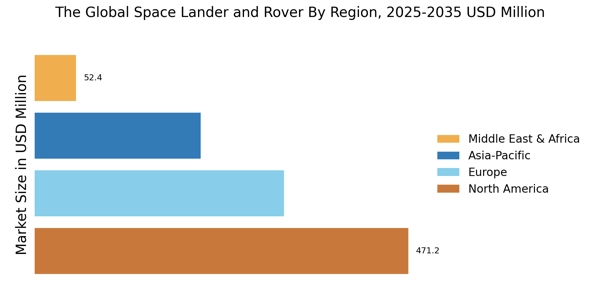

FIGURE 3: GLOBAL SPACE LANDER AND ROVER MARKET, BY REGION, 2022 VS 2032 (USD MILLION)

Based on Region, the Global Space Lander and Rover is segmented into North America, Europe, Asia-Pacific, Middle East & Africa, and South America. Further, the major countries studied in the market report are the U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

North America comprises of US, Canada, and Mexico. The market is dominated by North America, because of the growing investment by NASA. NASA's budget for the year 2021 is USD 23.3 billion, representing a 3% increase as compared to the previous year. NASA's Perseverance rover is advanced to touch down safely on Mars planet. The design as well construction of the rover along with its related components accounts for 81% of the whole project cost, while the rest components for launch as well as operations.

The rover's dependency on Plutonium-238 as a power source has grown the launch costs because of the elevated environmental as well as safety regulations for launching nuclear material. Players are also concentrating on several lunar missions. Intuitive Machines, a private company, is working on its first lunar mission in Q3 of 2023. The space sector is witnessing the development of advanced technologies, for instance, reusable launch vehicles, CubeSats, and smallsats.

Technological advancement has made it cost-effective to develop new space systems as well launching payloads into space, which in turn has enhanced a broad range of organizations for participating in the space sector. The agency's government investment in the sector, as it allows for affordable access to space as well as new business models, for instance, constellations. SmallSats witnessed around 95% of spacecraft launched in the year 2022. Satellite constellations will also drive the space lander and rover market in the future. There could be growth in demand for satellite integrations, launch vehicles, and components.

Satellite constellations can provide global coverage, for example, at least one satellite anywhere on earth. Furthermore, investment in the private sector, a growing number of venture capital firms, as well as private equity firms, have been doing investments in the space sector as well as many private players are entering the market for providing space-related products as well as services. Till the end of the year 2022, the global space sector had attracted investment of around USD 272 billion in 1,791 companies since the year 2013. Moreover, investment in national security space is growing quickly.

For example, in the US the financial year 2023 allocated a budget of USD 20.8 billion national security space budget which is a 19.5% increase for the year 2022. The roundtrip mission will take about two years.Technology development for a crewed Mars mission is already underway. Many of the technologies will be tested on the Moon during the Artemis missions, while others are more suited for deep space. Here are six technologies NASA is working on to make Mars a reality. In order to create a robotic lunar rover that will launch in 2026, Canada is working with NASA.

Two scientific equipment, one from Canada and one from the United States, will be carried by the rover. The rover's capacity to last a whole lunar night is one of the mission's primary objectives, along with collecting photos and measurements of the lunar surface.The rover is a component of Canada's 2022-released Space Policy Framework. With a focus on the Moon and Mars, the framework outlines Canada's goals for space exploration in the upcoming years. The rover represents a significant advancement for Canada's space programme and will be a useful tool for the Artemis programme of NASA.

Europe comprises countries like the UK, Germany, France, Italy, Spain, and the Rest of Europe. Space rovers are vehicles designed for traviling over the rugged as well as mountainous terrain of moon, other planets and astriods. A rover is robot is used for exploring the surface of celestial body. Rovers and Lander are used for variety of purpose includes Planetary exploration, asteriod mining, Search for life, space tourism. Many rovers have been sent to moon, mars and even asteriods in previous year.

Space mining market obtained momentum as well as different space agencies are planning for launching rovers and orbiters to various different celestial bodies for detecting the presence of different material platinum, gold, titanium, silver, cobalt, iron and nickel. The European Space Agency has launched a space lander under its exploration efforts. The advanced lander, equipped with advance technology, focus to delve into the study of celestial bodies within the solar system. The region has experrienced significant growth in sector. Missons such as ExoMars as well as upcoming the Phiae lander for the for the Rosetta mission.

A as advancement in technology as well as new missions are planned, the European space rover and lander market is continuously evolving, contributing to understanding of universe. In the region scientific exploration as well as research initiatives drives demand for advance rovers and landers, fostering discoveries on astronomical bodies such as moon and mars. Government investment such as The European Space Agency (ESA) has approved a record-breaking budget of nearly USD 18.9 billion.

The budget will help fund a range of ambitious projects, including the rebuilding of the landing platform for the ExoMars rover, the development of Europe's own secure communications satellite constellation, and a lunar lander called Argonaut. The budget represents a 17% increase from the previous budget approved in 2019. It was approved at ESA's Council at the Ministerial level in Paris on Wednesday, November 23.

The European Space Agency (ESA) is committed to the UK-built Rosalind Franklin Mars Rover. The rover is set to launch to Mars in 2028, and UK industry will play a leading role in developing a new landing platform for the rover.

The UK is also a leader in space sustainability. The UK is developing technologies to manage, maintain, and retrieve satellites in space. This will help to reduce the amount of space debris in orbit and support the UK's ambitions to lead in global space sustainability regulation and innovation.

Asia Pacific New comprises countries like the China, India, Japan, South Korea, Australia, Rest of Asia Pacific. In the region technologies are making it easier and more affordable to land and operate rovers on other planets. Autonomous landing systems can land rovers with greater precision than human-controlled systems, reducing the risk of damage during landing. Lightweight and powerful materials are making it possible to build rovers that can traverse difficult terrain, allowing them to explore more of a planet's surface. Improved communication systems allow scientists to control rovers and receive data in real time, even from remote areas.

These advances are making space exploration more accessible and affordable, leading to a new era of cooperation between countries and private companies to explore the solar system and beyond. Robots like the Perseverance rover are teaching us about the surface of Mars. This information will help us plan future human missions to the Red Planet.

We will need to develop new technologies to get humans to Mars, explore the surface, and safely return them home. Developing countries such as India, the space agency launched a rocket in July 2023 that sent a spacecraft into orbit as well as toward a planned landing in month of August on the lunar south pole. ISRO (The Indian Space Research Organisation’s) LVM3 launch rocket blasted off the major spaceport in Andhra Pradesh.