Space Technology Market

1. Introduction

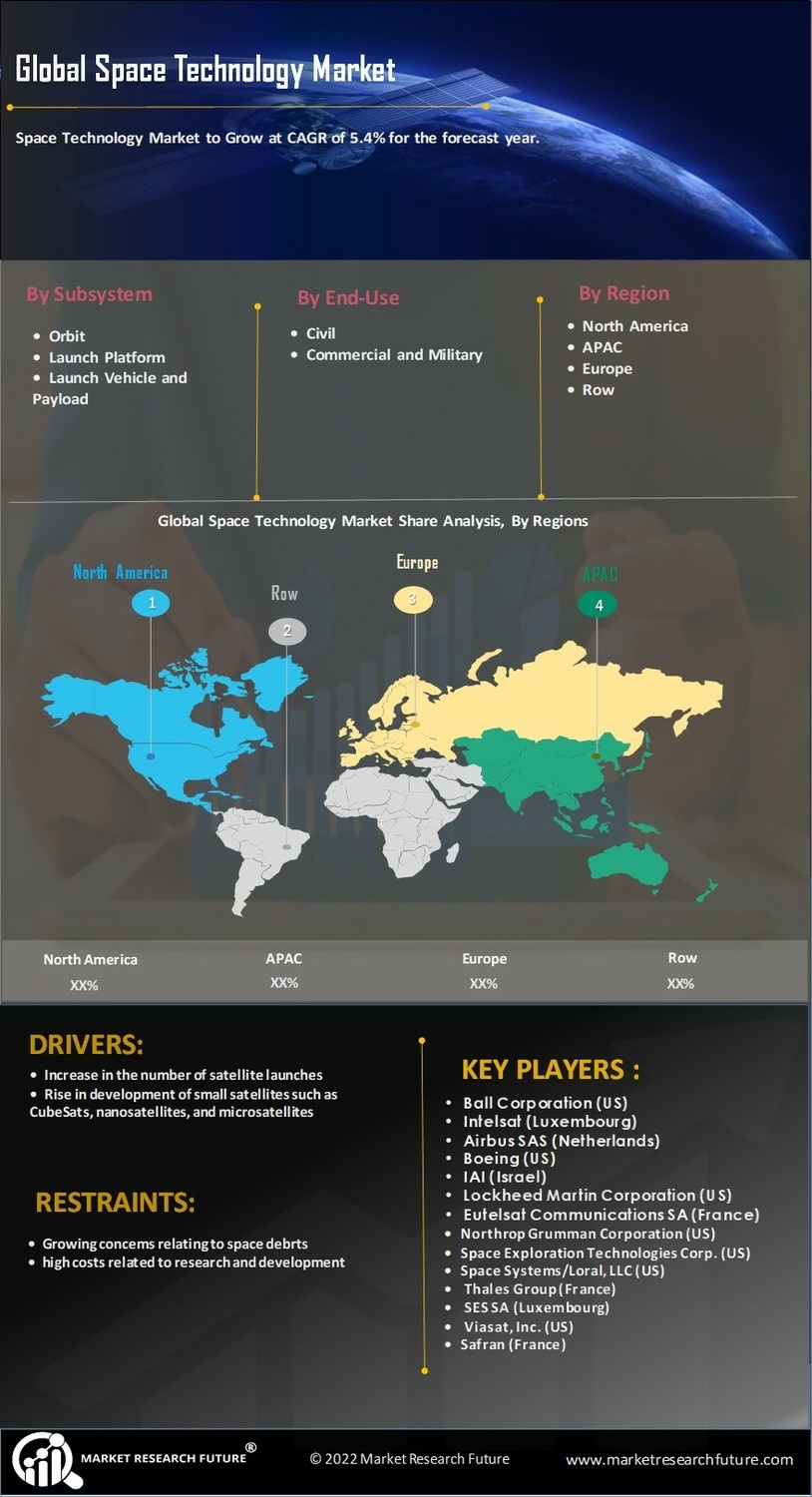

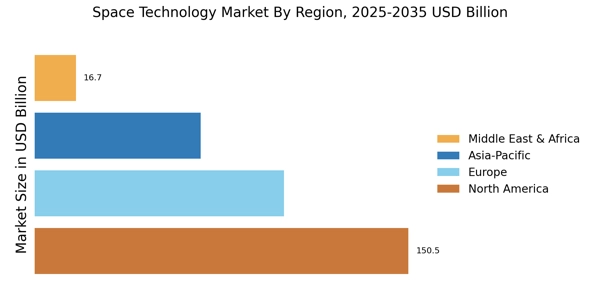

This research report provides an analysis of the Global Space Technology Market. It evaluates the size and growth of the space technology market and provides a detailed examination of the estimated market trends from 2023 to 2030. The market is segmented based on Satellite Launch Vehicles, Aerospace, Propulsion Systems, Avionics and communications, Surveillance and navigation, Earth Observation, Missiles and defence, Robotics and Automation, and Others.

2. Research Objective

The purpose of this research report is to analyze the growth prospects and market dynamics in the global space technology market. The primary objectives of the report are to:

- Analyze the size and growth of the Global Space Technology Market.

- Estimate the market size and growth rate for 2023 – 2030.

- Analyse the key factors affecting the growth of the Global Space Technology Market.

- Assess the competitive landscape of the Global Space Technology Market.

- Provide an overview of the major developments in the Global Space Technology Market.

3. Scope of Study

This research report provides an in-depth analysis of the global space technology market. The study includes an overview of the key market players, trends in the market, regional analysis, and drivers and challenges. The report further provides a detailed analysis of the market based on satellite launch vehicles, aerospace components, propulsion systems, avionics and communications, surveillance and navigation, earth observation, missiles and defence systems, robotics and automation, and others. The market size and growth rate of each segment have been estimated for the period 2023-2030.

4. Research Methodology

The research methodology employed for the analysis of the Global Space Technology Market is based on a combination of private and public databases, primary and secondary research, and bottom-up and top-down approaches.

4.1 Secondary Research

Secondary research was conducted to estimate the size and growth of the global space technology market. It includes information from authoritative sources such as market research reports, industry journals, annual reports by leading players, and industry associations, government organizations, and trade magazines. The key parameters for the evaluation of the global space technology market were obtained from the secondary research.

4.2 Primary Research

Primary research was conducted to supplement the secondary research. It includes interviews and discussions with industry experts, industry veterans, and senior executives. The research used a combination of primary and secondary data sources to evaluate the market size and growth rate.

4.3 Bottom-Up Approach

The bottom-up approach was used to estimate the global space technology market. The bottom-up approach involves the assessment of the market size of each segment. The estimated market size was further validated by industry experts.

4.4 Top-Down Approach

The top-down approach was used to validate the estimated market size of the global space technology market. The top-down approach involved the estimation of the market size of each segment based on primary and secondary research.

4.5 Factor Analysis

Factor analysis was used to identify the key factors affecting the growth of the global space technology market. The key factors included technological innovations, government policies, market trends, and competitive landscape.

4.6 Time Series Analysis

Time series analysis was used to derive the historical data of the global space technology market. The historical data was used to estimate the market size and growth rate of the global space technology market for the period 2023-2030.

4.7 Demand Side and Supply Side Data Triangulation

Demand-side and supply-side data triangulation was used to validate the estimated market size of the global space technology market. The demand side triangulation included analysis of the end-user industries, demand side factors, and market trends. The demand-side triangulation was matched with the supply-side triangulation which included the supply-side factors, regional trends, and market dynamics.

5. Conclusion

The research report included an analysis of the global space technology market. The report provides an in-depth analysis of the major trends, growth drivers and challenges in the global space technology market. The report provides a detailed analysis of the estimated market size and growth rate of the global space technology market for the period 2023-2030. The report further describes the key factors affecting the growth of the global space technology market. The report concludes with a summary of the research findings and recommendations for future research.