Innovative Product Development

The Soy Beverage Market is witnessing a surge in innovative product development, which is crucial for attracting diverse consumer segments. Manufacturers are increasingly introducing flavored soy beverages, fortified options, and ready-to-drink formats to cater to varying tastes and preferences. This innovation is not only enhancing the appeal of soy beverages but also expanding their market reach. For instance, the introduction of soy beverages enriched with vitamins and minerals is appealing to health-conscious consumers seeking functional foods. Additionally, the rise of convenience-oriented products aligns with busy lifestyles, further driving growth in the Soy Beverage Market. As companies continue to innovate, the competitive landscape is likely to evolve, fostering a dynamic market environment.

Expansion of Distribution Channels

The Soy Beverage Market is experiencing an expansion of distribution channels, which is vital for increasing product accessibility. Retailers are increasingly recognizing the demand for soy beverages and are incorporating them into their product offerings. This includes placement in mainstream grocery stores, health food shops, and online platforms. The rise of e-commerce has particularly transformed the way consumers purchase soy beverages, allowing for greater convenience and variety. As distribution channels continue to diversify, the Soy Beverage Market is likely to see enhanced visibility and availability, ultimately driving sales growth. This trend underscores the importance of strategic partnerships and marketing efforts in reaching a broader audience.

Sustainability and Ethical Consumption

The Soy Beverage Market is significantly influenced by the increasing consumer focus on sustainability and ethical consumption. As environmental concerns gain prominence, many consumers are opting for plant-based products, including soy beverages, as a more sustainable choice compared to dairy. The production of soy beverages typically requires fewer resources and generates lower greenhouse gas emissions than traditional dairy farming. This shift towards eco-conscious consumption is prompting brands to highlight their sustainable practices, thereby attracting environmentally aware consumers. The Soy Beverage Market stands to benefit from this trend, as more individuals seek products that align with their values regarding sustainability and ethical sourcing.

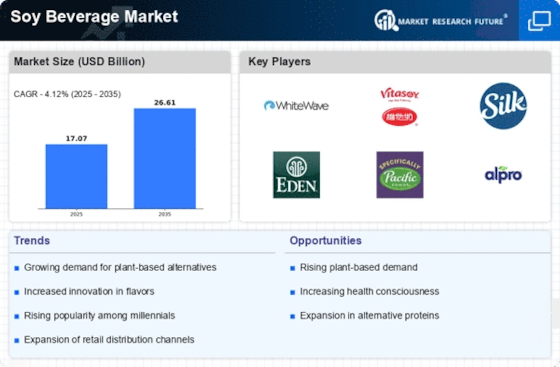

Rising Demand for Plant-Based Alternatives

The Soy Beverage Market is experiencing a notable increase in demand for plant-based alternatives to dairy products. This trend is largely driven by a growing awareness of health and environmental issues associated with traditional dairy consumption. According to recent data, the plant-based beverage segment, which includes soy beverages, is projected to grow at a compound annual growth rate of approximately 10% over the next five years. Consumers are increasingly seeking lactose-free options, and soy beverages are often perceived as a nutritious alternative, rich in protein and essential nutrients. This shift in consumer preferences is likely to propel the Soy Beverage Market forward, as more individuals adopt plant-based diets for health benefits and ethical considerations.

Increased Awareness of Nutritional Benefits

The Soy Beverage Market is benefiting from heightened awareness regarding the nutritional advantages of soy-based products. Soy beverages are recognized for their high protein content, low saturated fat levels, and presence of essential amino acids. Research indicates that soy consumption may contribute to heart health and lower cholesterol levels, which resonates with health-conscious consumers. As individuals become more informed about the benefits of incorporating soy into their diets, the demand for soy beverages is expected to rise. This trend is further supported by dietary guidelines that encourage the consumption of plant-based proteins, positioning the Soy Beverage Market as a key player in the health and wellness sector.