Aging Population Impact

The aging population in South Korea is a crucial driver for the pharmacy market. As the demographic shifts towards an older age group, the demand for pharmaceuticals and healthcare services is expected to rise significantly. By 2025, it is projected that over 20% of the population will be aged 65 and above, leading to increased prevalence of chronic diseases. This demographic trend necessitates a robust pharmacy market to cater to the growing needs for medications, consultations, and health management services. Furthermore, the pharmacy market is likely to see a surge in demand for specialized medications tailored for geriatric patients, thereby influencing market dynamics and growth strategies for pharmacy operators.

Rising Health Awareness

Rising health awareness among the South Korean population is significantly influencing the pharmacy market. With an increasing focus on preventive healthcare and wellness, consumers are more inclined to seek out pharmacies for health consultations and over-the-counter products. Surveys indicate that nearly 70% of South Koreans are actively seeking information about health and wellness, which is driving demand for health-related products and services. This trend is likely to propel the pharmacy market towards offering a wider range of health supplements, preventive medications, and wellness programs. Consequently, pharmacies are adapting their business models to include health education and preventive care services, thereby enhancing their role in the healthcare ecosystem.

E-commerce Growth in Pharmacy

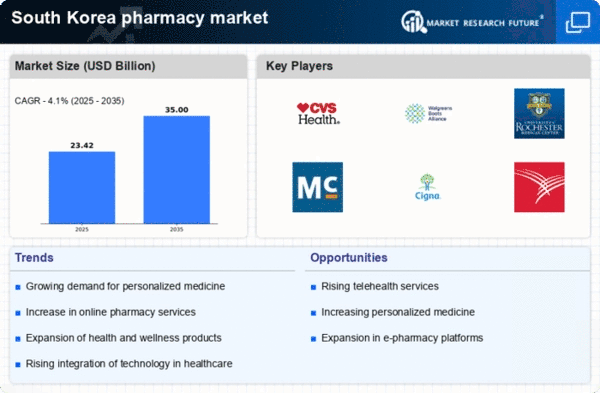

The growth of e-commerce is emerging as a significant driver for the pharmacy market in South Korea. With the increasing penetration of the internet and mobile devices, consumers are increasingly turning to online platforms for purchasing medications and health products. As of 2025, it is estimated that online sales in the pharmacy market could account for over 25% of total sales, reflecting a shift in consumer behavior. This trend is prompting traditional pharmacies to enhance their online presence and develop e-commerce strategies to remain competitive. Furthermore, the convenience of home delivery services and online consultations is likely to attract a broader customer base, thereby transforming the landscape of the pharmacy market.

Government Initiatives and Policies

Government initiatives and policies play a pivotal role in shaping the pharmacy market in South Korea. The government has been actively promoting policies aimed at improving access to medications and enhancing the quality of healthcare services. Recent reforms have focused on reducing drug prices and increasing the availability of essential medicines, which is expected to stimulate growth in the pharmacy market. Additionally, the government is investing in healthcare infrastructure, which includes expanding pharmacy services in rural areas. These initiatives are likely to create a more favorable environment for pharmacy operations, encouraging innovation and competition within the market.

Technological Advancements in Pharmacy

Technological advancements are reshaping the pharmacy market in South Korea. Innovations such as automated dispensing systems, telepharmacy, and electronic health records are enhancing operational efficiency and patient care. The integration of artificial intelligence in drug management and patient monitoring systems is expected to improve accuracy and reduce errors. As of 2025, the pharmacy market is anticipated to witness a growth rate of approximately 10% annually, driven by these technological innovations. Moreover, the adoption of mobile health applications is empowering patients to manage their medications more effectively, thus increasing engagement and adherence to treatment regimens. This technological evolution is likely to redefine the competitive landscape of the pharmacy market.