Increasing Health Awareness

There is a growing trend of health awareness among consumers in South America, which is positively influencing the pharmacy market. As individuals become more informed about health issues and preventive care, they are more likely to seek out medications and health products. This shift is reflected in the rising sales of over-the-counter (OTC) medications and health supplements. Recent statistics indicate that the OTC segment is expected to grow by 12% annually, driven by increased consumer spending on health and wellness. Additionally, educational campaigns by health organizations are further promoting the importance of medication adherence and preventive care, which could lead to a more proactive approach to health management. Consequently, this heightened awareness is likely to bolster the pharmacy market in the region.

Rising Demand for Pharmaceuticals

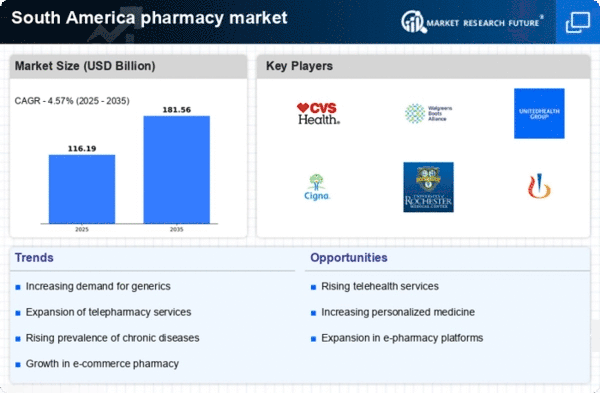

The pharmacy market in South America is experiencing a notable increase in demand for pharmaceuticals, driven by a growing population and rising healthcare needs. As the population ages, the prevalence of chronic diseases such as diabetes and hypertension is on the rise, leading to an increased consumption of prescription medications. According to recent data, the pharmaceutical sector in South America is projected to grow at a CAGR of approximately 8% over the next five years. This growth is indicative of a broader trend where consumers are seeking more effective treatments, thereby propelling the pharmacy market forward. Additionally, the expansion of health insurance coverage in various countries is likely to enhance access to medications, further stimulating demand within the pharmacy market.

Government Initiatives and Support

Government initiatives aimed at improving healthcare access are playing a crucial role in shaping the pharmacy market in South America. Various countries are implementing policies to enhance the availability of essential medications and reduce costs for consumers. For instance, some governments are subsidizing the prices of critical drugs, making them more affordable for the population. Additionally, regulatory frameworks are being established to streamline the approval process for new medications, which could lead to a more diverse range of products available in the market. These initiatives are expected to foster a more competitive environment within the pharmacy market, potentially leading to a projected growth rate of 7% in the coming years. Such government support is vital for ensuring that the pharmacy market continues to thrive in South America.

Expansion of E-commerce in Pharmacy

The rise of e-commerce is reshaping the pharmacy market in South America, providing consumers with greater access to medications and health products. Online pharmacies are becoming increasingly popular, offering convenience and competitive pricing. This trend is particularly appealing to younger consumers who prefer the ease of online shopping. Data suggests that the online pharmacy segment is expected to grow by 15% over the next few years, driven by the increasing penetration of the internet and mobile devices. Moreover, the COVID-19 pandemic has accelerated the shift towards online purchasing, as consumers seek safer alternatives for obtaining medications. This expansion of e-commerce is likely to create new opportunities for pharmacies to reach a broader customer base, thereby enhancing the overall growth of the pharmacy market.

Technological Advancements in Pharmacy

Technological innovations are significantly impacting the pharmacy market in South America. The integration of advanced technologies such as telepharmacy and electronic health records is transforming how pharmacies operate. These advancements facilitate better patient management and enhance the efficiency of pharmaceutical services. For instance, telepharmacy allows patients in remote areas to access medications and consultations without the need for physical visits. Furthermore, the adoption of automated dispensing systems is improving accuracy and reducing wait times for patients. As a result, pharmacies are likely to see an increase in customer satisfaction and loyalty, which could lead to a projected growth of 10% in the sector over the next few years. This trend underscores the importance of embracing technology in the pharmacy market.