Rising Healthcare Expenditure

The South America Pharmacy Management System Market is benefiting from the rising healthcare expenditure across the region. Governments and private sectors are investing significantly in healthcare infrastructure, which includes the modernization of pharmacy services. This investment is likely to enhance the adoption of pharmacy management systems that can support the growing volume of prescriptions and improve service delivery. As healthcare spending continues to rise, pharmacies are expected to allocate more resources towards technology solutions that optimize their operations. This trend indicates a robust market potential for pharmacy management systems, as they play a crucial role in enhancing the efficiency and effectiveness of pharmacy services.

Integration of Telepharmacy Services

The integration of telepharmacy services is emerging as a key driver in the South America Pharmacy Management System Market. With the increasing acceptance of telehealth solutions, pharmacies are exploring ways to offer remote consultations and medication management services. Pharmacy management systems that support telepharmacy functionalities enable pharmacists to provide consultations, manage prescriptions, and monitor patient adherence from a distance. This trend not only expands the reach of pharmacy services but also enhances patient convenience. As telepharmacy gains traction, the demand for integrated management systems that facilitate these services is likely to grow, reflecting a shift towards more accessible healthcare solutions.

Regulatory Compliance and Safety Standards

In the South America Pharmacy Management System Market, adherence to regulatory compliance and safety standards is paramount. Governments across the region are implementing stringent regulations to ensure the safe dispensing of medications and the protection of patient data. Pharmacy management systems that incorporate compliance features are becoming essential tools for pharmacies to navigate these regulations effectively. For instance, systems that facilitate electronic prescriptions and maintain accurate records help pharmacies comply with local laws. The increasing focus on patient safety and data security is likely to drive the demand for advanced management systems, as pharmacies strive to meet these evolving standards.

Growing Demand for Efficient Pharmacy Operations

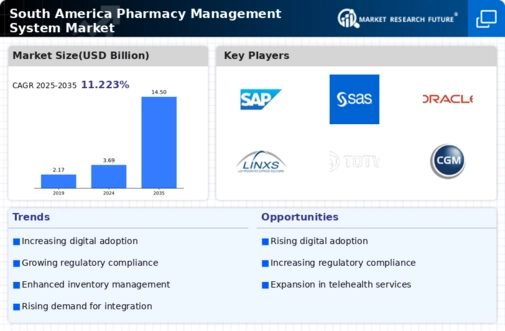

The South America Pharmacy Management System Market is experiencing a surge in demand for efficient pharmacy operations. As the healthcare landscape evolves, pharmacies are increasingly seeking solutions that streamline their processes, reduce errors, and enhance customer service. The integration of advanced management systems allows pharmacies to automate inventory management, prescription processing, and billing, thereby improving operational efficiency. According to recent data, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 10% over the next five years. This growth is driven by the need for pharmacies to adapt to changing consumer expectations and regulatory requirements, making the adoption of sophisticated management systems a priority.

Technological Advancements in Pharmacy Management

Technological advancements are significantly influencing the South America Pharmacy Management System Market. Innovations such as artificial intelligence, machine learning, and data analytics are being integrated into pharmacy management systems to enhance decision-making and operational efficiency. These technologies enable pharmacies to analyze patient data, predict medication needs, and optimize inventory management. As pharmacies increasingly recognize the value of data-driven insights, the demand for advanced management systems that leverage these technologies is expected to rise. This trend suggests a transformative shift in how pharmacies operate, positioning technology as a critical component in the future of pharmacy management.