Advancements in Biotechnology

Technological advancements in biotechnology are significantly impacting the biotechnology pharmaceutical-services-outsources market. Innovations in gene editing, such as CRISPR technology, and improvements in biomanufacturing processes are enabling more efficient drug development and production. In South Korea, the biotechnology sector is projected to reach a market size of $10 billion by 2026, driven by these advancements. Furthermore, the integration of artificial intelligence in drug discovery is streamlining the identification of potential therapeutic candidates, thereby reducing time-to-market. As these technologies continue to evolve, they are likely to enhance the capabilities of the biotechnology pharmaceutical-services-outsources market, fostering a more competitive landscape.

Increasing Demand for Biologics

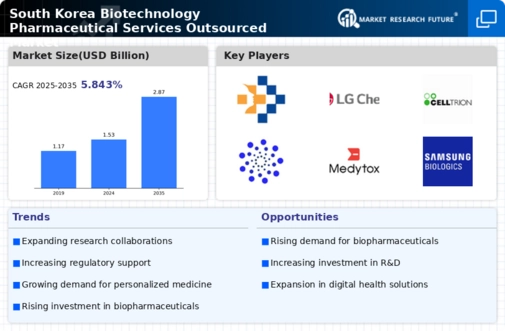

The biotechnology pharmaceutical-services-outsources market is experiencing a notable surge in demand for biologics, driven by their efficacy in treating complex diseases. In South Korea, the biopharmaceutical sector has seen a growth rate of approximately 15% annually, reflecting a shift towards biologics over traditional small-molecule drugs. This trend is likely to continue as healthcare providers and patients increasingly favor biologics for their targeted therapeutic effects. The growing prevalence of chronic diseases, such as diabetes and cancer, further fuels this demand, compelling pharmaceutical companies to invest in biologics development. Consequently, the biotechnology pharmaceutical-services-outsources market is poised to benefit from this increasing focus on biologics, as companies seek to enhance their R&D capabilities and streamline production processes.

Rising Focus on Sustainable Practices

Sustainability is becoming a critical focus within the biotechnology pharmaceutical-services-outsources market. Companies are increasingly adopting environmentally friendly practices in their operations, driven by both regulatory pressures and consumer demand for sustainable products. In South Korea, the government has set ambitious targets for reducing carbon emissions, prompting biopharmaceutical companies to invest in green technologies and sustainable manufacturing processes. This shift not only aligns with global sustainability goals but also enhances the reputation of companies within the biotechnology sector. As sustainability becomes a core component of business strategy, the biotechnology pharmaceutical-services-outsources market is likely to see a transformation in operational practices, leading to long-term benefits.

Regulatory Support for Biotech Innovations

Regulatory frameworks in South Korea are increasingly supportive of innovations within the biotechnology pharmaceutical-services-outsources market. The government has implemented policies aimed at expediting the approval process for biopharmaceuticals, which is crucial for fostering innovation. For instance, the Ministry of Food and Drug Safety has introduced a fast-track approval system for new drugs, significantly reducing the time required for market entry. This regulatory environment encourages investment in R&D and enhances the attractiveness of the biotechnology sector. As a result, companies are more likely to engage in outsourcing services to navigate the complex regulatory landscape, thereby bolstering the biotechnology pharmaceutical-services-outsources market.

Growing Collaboration Between Academia and Industry

The biotechnology pharmaceutical-services-outsources market is witnessing an increase in collaborations between academic institutions and industry players. In South Korea, universities are becoming vital hubs for biopharmaceutical research, often partnering with biotech firms to translate academic discoveries into commercial products. This synergy is expected to enhance innovation and accelerate the development of new therapies. The government has also initiated funding programs to support these collaborations, further strengthening the ecosystem. As a result, the biotechnology pharmaceutical-services-outsources market is likely to benefit from a steady pipeline of innovative products emerging from these partnerships, fostering growth and competitiveness.