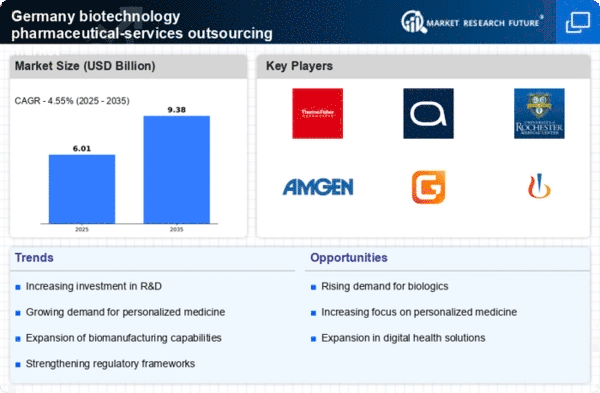

Growing Demand for Biologics

The biotechnology pharmaceutical-services-outsources market is experiencing a notable increase in demand for biologics, which are complex drugs derived from living organisms. In Germany, the market for biologics is projected to reach approximately €20 billion by 2026, driven by advancements in biotechnology and an aging population requiring innovative therapies. This demand is further fueled by the rising prevalence of chronic diseases, such as diabetes and cancer, which necessitate targeted treatment options. As a result, pharmaceutical companies are increasingly outsourcing their biologics development and manufacturing processes to specialized service providers, enhancing efficiency and reducing costs. The growing focus on biologics is likely to reshape the landscape of the biotechnology pharmaceutical-services-outsources market, as companies seek to leverage external expertise to meet the evolving needs of patients and healthcare systems.

Increased Focus on Cost Efficiency

Cost efficiency is becoming a critical driver in the biotechnology pharmaceutical-services-outsources market, particularly as companies seek to optimize their operations. In Germany, pharmaceutical firms are increasingly outsourcing non-core activities to specialized service providers, allowing them to focus on their core competencies while reducing operational costs. This trend is reflected in the growing market for contract research organizations (CROs) and contract manufacturing organizations (CMOs), which are projected to expand by approximately 15% annually over the next five years. By leveraging the expertise and resources of these outsourcing partners, companies can achieve greater flexibility and scalability in their operations. Consequently, the emphasis on cost efficiency is likely to continue shaping the strategies of firms within the biotechnology pharmaceutical-services-outsources market, driving further growth and innovation.

Regulatory Environment Favoring Innovation

The regulatory framework in Germany is evolving to support innovation within the biotechnology pharmaceutical-services-outsources market. Recent initiatives by the Federal Institute for Drugs and Medical Devices (BfArM) aim to expedite the approval processes for novel therapies, particularly those addressing unmet medical needs. This regulatory support is crucial, as it encourages pharmaceutical companies to invest in research and development, knowing that their innovations can reach the market more swiftly. Furthermore, the introduction of adaptive licensing pathways allows for more flexible clinical trial designs, which can lead to faster patient access to new treatments. As a result, the biotechnology pharmaceutical-services-outsources market is likely to benefit from a more conducive regulatory environment, fostering collaboration between industry stakeholders and enhancing the overall innovation ecosystem.

Rising Investment in Biotechnology Startups

Investment in biotechnology startups is witnessing a surge in Germany, significantly impacting the biotechnology pharmaceutical-services-outsources market. Venture capital funding for biotech firms has increased by over 30% in recent years, reflecting a growing confidence in the potential of innovative therapies and technologies. This influx of capital is enabling startups to advance their research and development efforts, often leading to groundbreaking discoveries in areas such as gene therapy and personalized medicine. As these startups collaborate with established pharmaceutical companies and outsourcing partners, they contribute to a vibrant ecosystem that fosters innovation and accelerates the development of new treatments. The rising investment landscape is likely to enhance the competitiveness of the biotechnology pharmaceutical-services-outsources market, positioning Germany as a key player in the global biotechnology arena.

Technological Advancements in Drug Development

Technological innovations are significantly transforming the biotechnology pharmaceutical-services-outsources market, particularly in drug development processes. In Germany, the integration of artificial intelligence (AI) and machine learning is streamlining research and development, enabling faster identification of potential drug candidates. This shift is expected to reduce the time to market for new therapies, which currently averages around 10-15 years. Moreover, advancements in genomics and proteomics are facilitating more precise targeting of diseases, thereby enhancing the efficacy of treatments. As a result, pharmaceutical companies are increasingly relying on outsourcing partners that possess cutting-edge technologies and expertise, thereby driving growth in the biotechnology pharmaceutical-services-outsources market. The ability to harness these technological advancements is likely to provide a competitive edge to companies operating within this dynamic landscape.