Rising Demand for Biosimilars

The demand for biosimilars is on the rise in South America, driven by the need for affordable alternatives to expensive biologic therapies. As patents for several blockbuster biologics expire, the protein therapeutics market is witnessing an influx of biosimilar products. These alternatives offer similar efficacy and safety profiles at a reduced cost, making them accessible to a broader patient population. Market analysis suggests that the biosimilars segment could capture approximately 30% of the total protein therapeutics market by 2027. This shift not only enhances treatment accessibility but also stimulates competition among manufacturers, potentially leading to further innovations in the protein therapeutics sector. The growing acceptance of biosimilars among healthcare providers and patients is likely to bolster the overall market growth.

Increased Focus on Preventive Healthcare

There is a growing emphasis on preventive healthcare in South America, which is influencing the protein therapeutics market. As healthcare systems shift towards preventive measures, there is an increasing recognition of the role of protein therapeutics in disease prevention and management. This trend is reflected in the rising adoption of therapies that target early-stage diseases and promote overall health. The protein therapeutics market is likely to benefit from this focus, as innovative treatments that enhance immune response and prevent disease progression gain traction. Projections indicate that the preventive healthcare segment could grow at a CAGR of around 9% over the next few years. This shift towards prevention not only improves patient outcomes but also reduces the long-term burden on healthcare systems, thereby driving demand for protein therapeutics.

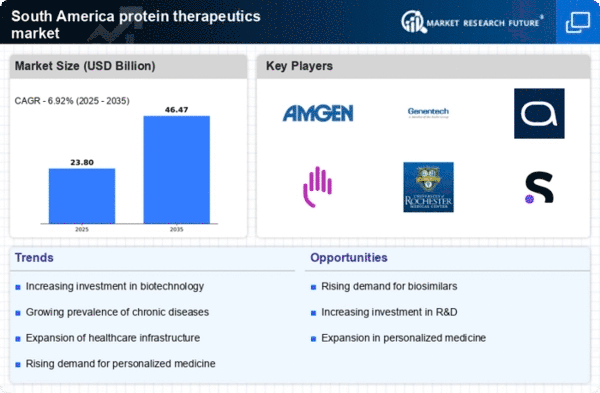

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases in South America is a pivotal driver for the protein therapeutics market. Conditions such as diabetes, cancer, and autoimmune disorders are becoming more prevalent, necessitating innovative treatment options. According to recent health statistics, chronic diseases account for approximately 60% of all deaths in the region. This alarming trend propels the demand for protein therapeutics, which offer targeted and effective treatment solutions. As healthcare systems strive to manage these diseases, the protein therapeutics market is likely to experience substantial growth, with projections indicating a compound annual growth rate (CAGR) of around 8% over the next five years. The increasing burden of chronic diseases underscores the urgent need for advanced therapeutic options, thereby driving investments and research in the protein therapeutics sector.

Advancements in Biomanufacturing Technologies

Technological advancements in biomanufacturing are significantly influencing the protein therapeutics market in South America. Innovations such as continuous manufacturing and improved cell culture techniques enhance the efficiency and scalability of protein production. These advancements not only reduce production costs but also improve the quality and consistency of therapeutic proteins. The protein therapeutics market is witnessing a shift towards more sustainable and cost-effective manufacturing processes, which could potentially lower the price of therapies for patients. As a result, the market is expected to expand, with estimates suggesting a growth rate of approximately 10% annually. The integration of cutting-edge biomanufacturing technologies is likely to facilitate the development of novel protein therapeutics, thereby addressing unmet medical needs in the region.

Growing Investment in Research and Development

Investment in research and development (R&D) within South America is a crucial driver for the protein therapeutics market. Governments and private entities are increasingly allocating funds to support biopharmaceutical research, aiming to foster innovation and enhance healthcare outcomes. In recent years, R&D expenditure in the biopharmaceutical sector has seen a notable increase, with estimates indicating a growth of over 15% annually. This influx of funding is likely to accelerate the discovery and development of new protein therapeutics, addressing various health challenges faced by the population. The protein therapeutics market stands to benefit from this trend, as enhanced R&D efforts could lead to breakthroughs in treatment options, ultimately improving patient care and outcomes across the region.