Advancements in Biotechnology

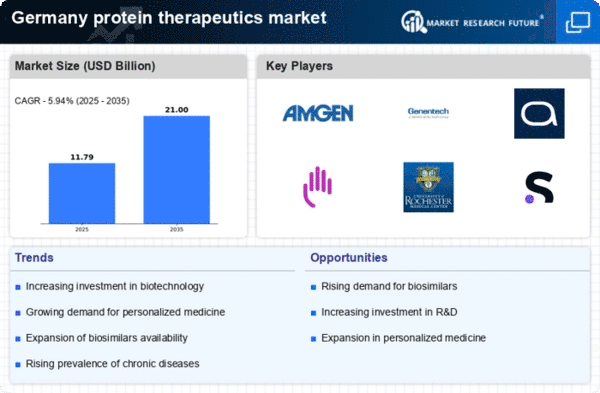

Technological innovations in biotechnology are significantly influencing the protein therapeutics market. In Germany, advancements in recombinant DNA technology, monoclonal antibody production, and protein engineering are paving the way for the development of novel therapeutics. As of 2025, the market for monoclonal antibodies alone is projected to reach €5 billion, reflecting a robust growth trajectory. These advancements enable the creation of more effective and targeted therapies, which are essential for treating complex diseases. Furthermore, the integration of artificial intelligence and machine learning in drug discovery processes is enhancing the efficiency of developing protein therapeutics. This technological evolution not only accelerates the time to market but also improves the overall success rates of new therapies. Consequently, the ongoing advancements in biotechnology are likely to drive the expansion of the protein therapeutics market in Germany, fostering a competitive landscape.

Supportive Regulatory Environment

Germany's regulatory framework plays a crucial role in shaping the protein therapeutics market. The European Medicines Agency (EMA) and the Federal Institute for Drugs and Medical Devices (BfArM) provide a structured pathway for the approval of new biologics. This supportive environment encourages innovation and expedites the development of protein therapeutics. In recent years, the approval process for biologics has become more streamlined, reducing the time to market. As of 2025, the number of approved protein therapeutics in Germany has increased by over 20% compared to previous years. This trend suggests that regulatory bodies are recognizing the importance of these therapies in addressing unmet medical needs. The favorable regulatory landscape not only boosts investor confidence but also attracts international companies to the German market, further enhancing growth potential.

Rising Patient Awareness and Education

Increasing patient awareness regarding treatment options is significantly impacting the protein therapeutics market in Germany. As patients become more informed about the benefits of biologics, there is a growing demand for these therapies. Educational initiatives by healthcare providers and patient advocacy groups are playing a vital role in disseminating information about protein therapeutics. By 2025, surveys indicate that over 60% of patients are aware of the advantages of protein-based treatments compared to traditional medications. This heightened awareness is likely to drive patient engagement in treatment decisions, leading to an increased uptake of protein therapeutics. Furthermore, as patients advocate for personalized treatment options, healthcare providers are compelled to consider protein therapeutics as viable solutions. Rising patient awareness and education are expected to create a favorable environment for the growth of the protein therapeutics market. More individuals are seeking these advanced treatment modalities.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases in Germany is a key driver for the protein therapeutics market. Conditions such as diabetes, cancer, and autoimmune disorders necessitate innovative treatment options. As of 2025, approximately 30% of the German population is affected by chronic diseases, leading to a heightened demand for biologics. This trend indicates a shift towards protein-based therapies, which are often more effective and targeted than traditional small-molecule drugs. The healthcare system's focus on improving patient outcomes further propels the adoption of protein therapeutics. Consequently, pharmaceutical companies are investing significantly in research and development to create novel protein-based treatments, thereby expanding the market landscape. The increasing prevalence of chronic diseases is likely to sustain growth in the protein therapeutics market, as healthcare providers seek advanced solutions to manage these conditions.

Growing Investment in Research and Development

Investment in research and development (R&D) is a critical driver for the protein therapeutics market in Germany. Pharmaceutical companies are increasingly allocating resources to discover and develop innovative protein-based therapies. In 2025, R&D spending in the German biopharmaceutical sector is expected to exceed €10 billion, reflecting a commitment to advancing therapeutic options. This influx of capital supports the exploration of new targets and the optimization of existing therapies, thereby enhancing the pipeline of protein therapeutics. Additionally, collaborations between academic institutions and industry players are fostering a culture of innovation, leading to breakthroughs in protein therapeutics. The emphasis on R&D contributes to growth and positions Germany as a leader in biopharmaceutical innovation. As a result, the protein therapeutics market is likely to benefit from a continuous stream of novel therapies emerging from these investments.