Increasing Demand for Biologics

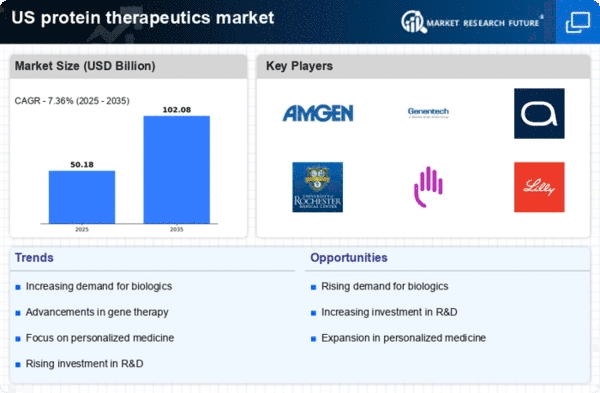

The protein therapeutics market is experiencing a notable surge in demand for biologics, which are derived from living organisms. This trend is largely driven by the growing prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders. According to recent estimates, the biologics segment is projected to account for over 40% of the total pharmaceutical market in the US by 2026. This increasing demand for biologics is compelling pharmaceutical companies to invest heavily in research and development, thereby propelling the growth of the protein therapeutics market. Furthermore, advancements in biotechnology are enabling the development of more effective and targeted therapies, which are likely to enhance patient outcomes and drive market expansion.

Rising Investment in Biotechnology

Investment in biotechnology is a critical driver of the protein therapeutics market. Venture capital funding for biotech firms has seen a substantial increase, with investments reaching approximately $20 billion in 2025 alone. This influx of capital is enabling companies to advance their research and development efforts, particularly in the field of protein therapeutics. Additionally, partnerships between biotech firms and larger pharmaceutical companies are becoming more common, facilitating the sharing of resources and expertise. This collaborative approach is likely to accelerate the development of innovative therapies, thereby enhancing the overall growth trajectory of the protein therapeutics market. As the biotechnology sector continues to thrive, it is expected to have a lasting impact on the protein therapeutics landscape.

Growing Awareness of Personalized Medicine

The increasing awareness of personalized medicine is significantly influencing the protein therapeutics market. Patients and healthcare providers are becoming more informed about the benefits of tailored therapies that cater to individual genetic profiles. This shift towards personalized treatment approaches is driving demand for protein therapeutics that can be customized to meet specific patient needs. As a result, pharmaceutical companies are focusing on developing targeted therapies that leverage genetic and molecular insights. The market for personalized medicine is projected to grow at a CAGR of over 10% through 2027, indicating a strong trend towards individualized treatment options. This growing emphasis on personalized medicine is likely to reshape the protein therapeutics market, fostering innovation and enhancing patient outcomes.

Technological Advancements in Drug Development

Technological innovations are playing a pivotal role in shaping the protein therapeutics market. The advent of advanced techniques such as CRISPR gene editing, monoclonal antibody technology, and high-throughput screening is revolutionizing the way new therapeutics are developed. These technologies not only expedite the drug discovery process but also improve the precision and efficacy of protein therapeutics. As a result, the market is witnessing a shift towards more sophisticated and targeted treatment options. The integration of artificial intelligence and machine learning in drug development is also expected to enhance the efficiency of clinical trials, potentially reducing the time to market for new therapies. This technological evolution is likely to attract significant investments, further stimulating growth in the protein therapeutics market.

Regulatory Support and Streamlined Approval Processes

The protein therapeutics market is benefiting from increased regulatory support and streamlined approval processes. Regulatory agencies, such as the FDA, are implementing initiatives aimed at expediting the review and approval of biologics and biosimilars. For instance, the FDA's 21st Century Cures Act has introduced measures to facilitate faster access to innovative therapies. This supportive regulatory environment is encouraging pharmaceutical companies to invest in the development of new protein therapeutics. Moreover, the establishment of clear guidelines for biosimilars is likely to enhance market competition, ultimately benefiting patients through increased access to affordable treatment options. As a result, the protein therapeutics market is expected to experience robust growth in the coming years.