Growing Awareness of Immunotherapy

Awareness of immunotherapy, particularly pd l1-inhibitors, is on the rise in South America, significantly impacting the market. Educational initiatives by healthcare providers and patient advocacy groups are playing a crucial role in informing both patients and healthcare professionals about the benefits of these therapies. As awareness increases, more patients are likely to seek out immunotherapy options, leading to a projected growth rate of 15% in the adoption of pd l1-inhibitors over the next five years. This shift in patient preference is expected to drive demand, prompting healthcare systems to integrate these therapies into standard treatment protocols. Consequently, the pd l1-inhibitors market is likely to expand, with an increasing number of healthcare facilities offering these advanced treatment options.

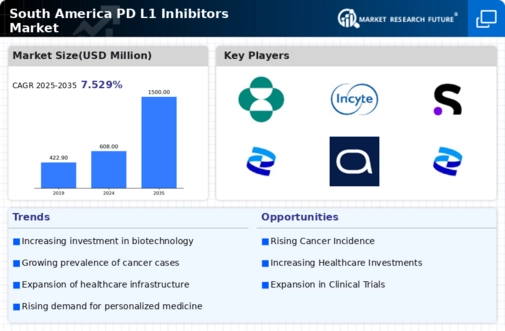

Expansion of Healthcare Infrastructure

The pd l1-inhibitors market is benefiting from the ongoing expansion of healthcare infrastructure across South America. Governments and private entities are investing in healthcare facilities, aiming to improve access to advanced cancer treatments. This expansion includes the establishment of specialized cancer treatment centers equipped with the latest technology for administering pd l1-inhibitors. Reports indicate that healthcare spending in the region is expected to grow by 10% annually, which will likely enhance the distribution and availability of these therapies. As more patients gain access to quality healthcare services, the demand for pd l1-inhibitors is anticipated to rise, further propelling the market forward. This infrastructure development is crucial for ensuring that innovative treatments reach the populations that need them most.

Increasing Investment in Oncology Research

The pd l1-inhibitors market in South America is experiencing a surge in investment directed towards oncology research. This trend is driven by the rising burden of cancer, which necessitates innovative treatment options. In recent years, funding from both public and private sectors has increased, with estimates suggesting that investment in cancer research could reach $1 billion by 2026. This influx of capital is likely to accelerate the development of pd l1-inhibitors, enhancing their availability and accessibility in the region. Furthermore, partnerships between pharmaceutical companies and research institutions are becoming more common, fostering an environment conducive to breakthroughs in cancer therapies. As a result, the pd l1-inhibitors market is poised for growth, with new products entering the market and existing therapies being optimized for better efficacy.

Regulatory Support for Innovative Therapies

Regulatory bodies in South America are increasingly supportive of innovative therapies, including pd l1-inhibitors, which is positively influencing the market. Streamlined approval processes and incentives for research and development are being implemented to encourage the introduction of new cancer treatments. For instance, recent regulatory reforms have reduced the time required for clinical trial approvals, potentially accelerating the entry of pd l1-inhibitors into the market. This supportive regulatory environment is expected to foster innovation, with projections indicating that the number of approved therapies could double by 2030. As a result, the pd l1-inhibitors market is likely to see a significant influx of new products, enhancing treatment options for patients.

Rising Collaborations Between Pharmaceutical Companies

Collaborations between pharmaceutical companies are becoming increasingly prevalent in the pd l1-inhibitors market in South America. These partnerships are often formed to leverage shared resources and expertise in the development of new therapies. By pooling knowledge and technology, companies can expedite the research and development process, leading to faster market entry for pd l1-inhibitors. Recent data suggests that collaborative projects in the pharmaceutical sector have increased by 20% over the past three years, indicating a robust trend towards cooperation. This collaborative spirit is likely to enhance innovation and improve the overall landscape of cancer treatment in the region, ultimately benefiting patients and healthcare providers alike.