Advancements in Biologics

Technological advancements in biologics significantly influence the Global Tumor Necrosis Factor Alpha Inhibitors Market Industry. The development of more targeted therapies has improved treatment outcomes for patients with chronic inflammatory diseases. Innovations in drug formulation and delivery systems enhance the efficacy and safety profiles of TNF-alpha inhibitors. For example, the introduction of biosimilars has increased accessibility and affordability, thereby expanding the market. As these advancements continue, the market is expected to grow at a CAGR of 4.02% from 2025 to 2035, potentially reaching 78.2 USD Billion by 2035, indicating a robust future for TNF-alpha inhibitors.

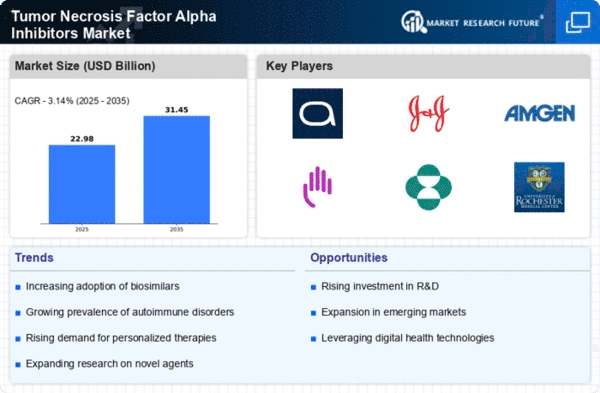

Market Growth Projections

The Global Tumor Necrosis Factor Alpha Inhibitors Market Industry is projected to experience substantial growth over the next decade. With a market value expected to reach 50.7 USD Billion in 2024 and further increase to 78.2 USD Billion by 2035, the industry is poised for a robust expansion. The anticipated CAGR of 4.02% from 2025 to 2035 indicates a steady growth trajectory, driven by factors such as rising prevalence of autoimmune diseases, advancements in biologics, and increasing healthcare expenditure. This growth reflects the ongoing demand for effective therapies and the commitment of the healthcare sector to address chronic inflammatory conditions.

Growing Awareness and Education

Enhanced awareness and education regarding autoimmune diseases and their treatments contribute to the growth of the Global Tumor Necrosis Factor Alpha Inhibitors Market Industry. Patients and healthcare professionals are increasingly informed about the benefits of TNF-alpha inhibitors, leading to higher rates of diagnosis and treatment initiation. Campaigns by health organizations and advocacy groups play a pivotal role in disseminating information about these therapies. As awareness increases, more patients seek treatment, thereby driving market demand. This trend is expected to sustain momentum, further solidifying the market's position in the healthcare landscape.

Regulatory Support and Approvals

Regulatory support and streamlined approval processes for TNF-alpha inhibitors significantly impact the Global Tumor Necrosis Factor Alpha Inhibitors Market Industry. Regulatory agencies, such as the FDA and EMA, are increasingly prioritizing the review of innovative therapies, facilitating quicker access to the market. This supportive environment encourages pharmaceutical companies to invest in research and development, leading to a broader range of treatment options for patients. The expedited approval processes not only enhance patient access to effective therapies but also stimulate market growth, ensuring that the industry remains dynamic and responsive to patient needs.

Increasing Healthcare Expenditure

The rise in global healthcare expenditure plays a crucial role in the expansion of the Global Tumor Necrosis Factor Alpha Inhibitors Market Industry. Countries are investing more in healthcare infrastructure and innovative treatments, driven by the need to improve patient outcomes. According to the World Bank, global health spending is projected to increase, allowing for broader access to advanced therapies, including TNF-alpha inhibitors. This trend is particularly evident in developed nations, where healthcare budgets are expanding to accommodate new treatment modalities. Consequently, this increased investment is likely to propel the market forward, supporting the anticipated growth trajectory.

Rising Prevalence of Autoimmune Diseases

The increasing incidence of autoimmune diseases globally drives the Global Tumor Necrosis Factor Alpha Inhibitors Market Industry. Conditions such as rheumatoid arthritis, psoriasis, and inflammatory bowel disease are becoming more prevalent, leading to a heightened demand for effective treatment options. For instance, the World Health Organization indicates that autoimmune diseases affect approximately 5-8% of the global population. This growing patient population necessitates the use of TNF-alpha inhibitors, which are known for their efficacy in managing these conditions. As a result, the market is projected to reach 50.7 USD Billion in 2024, reflecting the urgent need for innovative therapies.