Expansion of Surgical Facilities

The expansion of surgical facilities across South America is a pivotal driver for the ligation devices market. As more hospitals and surgical centers are established, the demand for ligation devices is expected to rise correspondingly. In 2025, it is estimated that the number of surgical facilities in the region will increase by 15%, leading to greater accessibility for patients requiring surgical interventions. This growth is likely to create a competitive environment, prompting facilities to invest in high-quality ligation devices to attract patients. Consequently, the ligation devices market is poised for growth as the expansion of surgical infrastructure aligns with the increasing need for effective surgical solutions in the region.

Increasing Healthcare Expenditure

The rising healthcare expenditure in South America is a crucial driver for the ligation devices market. Governments and private sectors are investing more in healthcare infrastructure, which enhances access to advanced medical technologies. In 2025, healthcare spending in the region is projected to reach approximately $500 billion, reflecting a growth rate of around 5% annually. This increase in funding allows hospitals and clinics to procure modern ligation devices, thereby improving surgical outcomes. Enhanced financial resources also facilitate training for healthcare professionals, ensuring they are adept at using these devices effectively. As a result, the ligation devices market is likely to experience significant growth, driven by the demand for improved surgical techniques and patient care in South America.

Rising Incidence of Chronic Diseases

The growing prevalence of chronic diseases in South America is a significant factor influencing the ligation devices market. Conditions such as obesity, diabetes, and cardiovascular diseases are on the rise, leading to an increase in surgical interventions. For instance, the World Health Organization indicates that the incidence of obesity in South America has increased by over 30% in the last decade. This trend necessitates the use of ligation devices in various surgical procedures, including bariatric surgeries. Consequently, the ligation devices market is expected to expand as healthcare providers seek effective solutions to manage these chronic conditions through surgical means. The demand for innovative ligation devices is likely to grow as more patients require surgical interventions to address their health issues.

Technological Innovations in Medical Devices

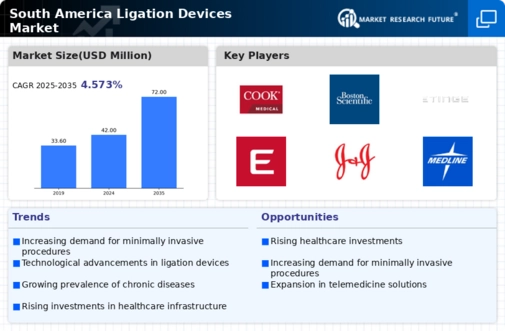

Technological advancements in medical devices are significantly impacting the ligation devices market in South America. Innovations such as advanced suturing techniques and the development of bioabsorbable materials are enhancing the efficacy and safety of ligation devices. In 2025, the market for advanced surgical devices is expected to reach $1 billion, with a substantial portion attributed to ligation devices. These innovations not only improve surgical outcomes but also reduce the overall costs associated with surgical procedures. As healthcare facilities adopt these new technologies, the ligation devices market is likely to benefit from increased demand for state-of-the-art surgical solutions that align with modern medical practices.

Growing Awareness of Minimally Invasive Procedures

There is a notable shift towards minimally invasive surgical procedures in South America, which serves as a key driver for the ligation devices market. Patients and healthcare providers are increasingly recognizing the benefits of such procedures, including reduced recovery times and lower risk of complications. As a result, the demand for ligation devices, which are essential in these types of surgeries, is on the rise. The market for minimally invasive surgeries is projected to grow at a CAGR of 7% through 2025, indicating a robust interest in these techniques. This trend is likely to propel the ligation devices market forward, as hospitals and surgical centers invest in the necessary equipment to meet patient expectations for less invasive treatment options.