Environmental Sustainability Initiatives

Environmental sustainability initiatives are becoming increasingly relevant in South America, influencing the refurbished medical-devices market. The push for greener practices has led healthcare facilities to consider the environmental impact of their equipment choices. Refurbished medical devices contribute to waste reduction by extending the lifecycle of existing equipment, thus minimizing landfill contributions. As healthcare organizations strive to meet sustainability goals, the refurbished medical-devices market is positioned to benefit. A recent survey indicated that over 60% of healthcare providers in South America are actively seeking sustainable options, which includes refurbished devices. This growing awareness of environmental responsibility is likely to drive demand for refurbished medical devices, as institutions aim to align their operations with eco-friendly practices.

Increased Focus on Healthcare Accessibility

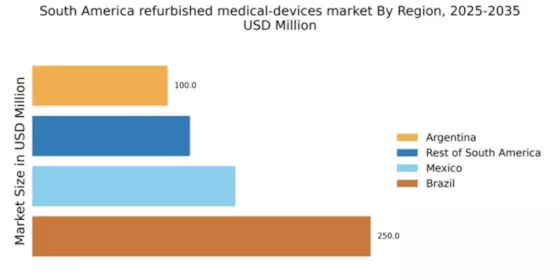

The focus on healthcare accessibility in South America is a significant driver for the refurbished medical-devices market. Many regions face challenges in providing adequate healthcare services, particularly in rural and underserved areas. Refurbished medical devices can play a crucial role in bridging this gap by offering affordable solutions that enable healthcare facilities to equip themselves adequately. The refurbished medical-devices market is likely to see growth as more organizations recognize the potential of refurbished equipment to enhance service delivery. Data suggests that approximately 40% of healthcare facilities in remote areas are considering refurbished devices to improve their service offerings. This trend indicates a shift towards ensuring that quality healthcare is accessible to all, regardless of location.

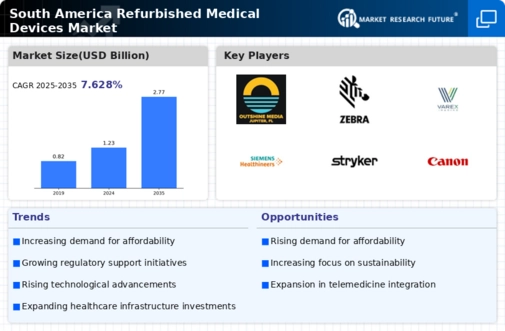

Rising Demand for Affordable Healthcare Solutions

The increasing demand for affordable healthcare solutions in South America is a primary driver for the refurbished medical-devices market. As healthcare costs continue to rise, hospitals and clinics are seeking cost-effective alternatives to new medical equipment. Refurbished devices offer a viable solution, providing quality equipment at a fraction of the cost. In South America, where healthcare budgets are often constrained, the refurbished medical-devices market is witnessing a surge in interest. Reports indicate that the market for refurbished medical devices in the region could grow by approximately 15% annually, as healthcare providers prioritize budget-friendly options without compromising on quality. This trend is likely to continue as more institutions recognize the benefits of refurbished devices, leading to increased adoption across various medical sectors.

Government Incentives for Medical Equipment Upgrades

Government incentives aimed at upgrading medical equipment are influencing the refurbished medical-devices market in South America. Various initiatives are being introduced to encourage healthcare facilities to modernize their equipment, which often includes the acquisition of refurbished devices. These incentives may take the form of tax breaks, grants, or subsidies, making it financially feasible for institutions to invest in refurbished medical devices. The refurbished medical-devices market stands to benefit from these policies, as they create a more favorable environment for the adoption of refurbished equipment. Preliminary data suggests that regions with government support for medical upgrades could see a 25% increase in the utilization of refurbished devices, as healthcare providers take advantage of these financial incentives.

Technological Advancements in Refurbishment Processes

Technological advancements in refurbishment processes are enhancing the quality and reliability of refurbished medical devices in South America. Innovations in testing, repair, and certification processes are ensuring that refurbished devices meet stringent safety and performance standards. This improvement in quality is likely to bolster confidence among healthcare providers, encouraging them to consider refurbished options. The refurbished medical-devices market is experiencing a transformation as these advancements make it possible to offer devices that are comparable to new ones. Reports indicate that the adoption of advanced refurbishment technologies could lead to a 20% increase in market share for refurbished devices over the next few years, as healthcare providers increasingly prioritize quality alongside cost.