Aging Population

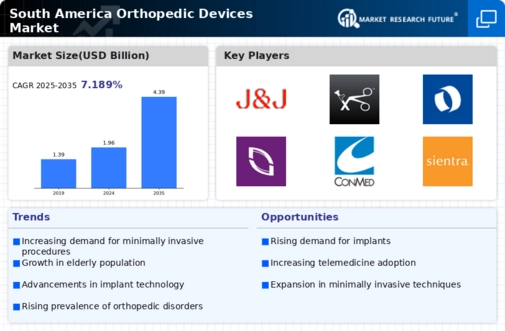

The aging population in South America is a critical driver for the orthopedic devices market. As life expectancy increases, the prevalence of age-related musculoskeletal disorders rises, leading to a higher demand for orthopedic interventions. It is estimated that by 2030, individuals aged 60 and above will constitute approximately 20% of the total population in several South American countries. This demographic shift necessitates the development and distribution of orthopedic devices tailored to the needs of older adults, including joint replacements and mobility aids. The orthopedic devices market is likely to experience substantial growth as healthcare providers adapt to these demographic changes, focusing on innovative solutions to enhance the quality of life for the elderly.

Increased Sports Participation

The growing interest in sports and physical activities among the South American population is driving the orthopedic devices market. With an increase in sports participation, there is a corresponding rise in sports-related injuries, necessitating the use of orthopedic devices for treatment and rehabilitation. According to recent data, sports injuries account for a significant portion of orthopedic consultations, with an estimated 30% of athletes requiring some form of orthopedic intervention. This trend is prompting manufacturers to innovate and expand their product lines, catering to the specific needs of athletes and active individuals. The orthopedic devices market is thus positioned for growth as it responds to the rising demand for specialized devices that facilitate recovery and enhance performance.

Healthcare Infrastructure Development

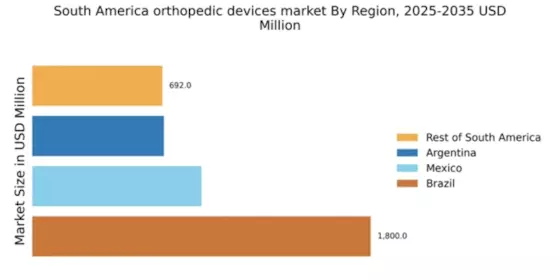

The ongoing development of healthcare infrastructure in South America is a pivotal factor influencing the orthopedic devices market. Governments and private sectors are investing in modernizing hospitals and clinics, which enhances the availability of advanced orthopedic care. Improved access to healthcare facilities is likely to increase the number of orthopedic procedures performed, thereby driving demand for orthopedic devices. For instance, Brazil and Argentina have seen significant investments in healthcare, with expenditures reaching approximately $100 billion in recent years. This investment is expected to bolster the orthopedic devices market, as enhanced facilities will support the adoption of innovative technologies and devices, ultimately improving patient outcomes.

Rising Awareness of Orthopedic Health

There is a growing awareness of orthopedic health issues among the South American population, which is significantly impacting the orthopedic devices market. Educational campaigns and health initiatives are informing individuals about the importance of early diagnosis and treatment of musculoskeletal disorders. This heightened awareness is leading to increased consultations with orthopedic specialists, resulting in a higher demand for orthopedic devices. Recent surveys indicate that approximately 40% of individuals in urban areas are now more proactive about seeking orthopedic care. Consequently, the orthopedic devices market is likely to benefit from this trend, as more patients seek interventions that can alleviate pain and improve mobility.

Technological Innovations in Device Design

Technological innovations in device design are transforming the orthopedic devices market in South America. Advances in materials science and engineering are leading to the development of lighter, stronger, and more biocompatible orthopedic devices. Innovations such as 3D printing and minimally invasive surgical techniques are enhancing the effectiveness and efficiency of orthopedic procedures. For instance, the introduction of custom-made implants is becoming increasingly popular, allowing for better patient outcomes. The orthopedic devices market is expected to grow as these technologies become more widely adopted, improving surgical precision and reducing recovery times for patients.