Ligation Devices Market Summary

As per Market Research Future analysis, the Ligation Devices Market Size was estimated at 0.44 USD Billion in 2024. The Ligation Devices industry is projected to grow from USD 0.4599 Billion in 2025 to USD 0.7165 Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.53% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The ligation devices market is poised for substantial growth driven by technological advancements and increasing demand for minimally invasive procedures.

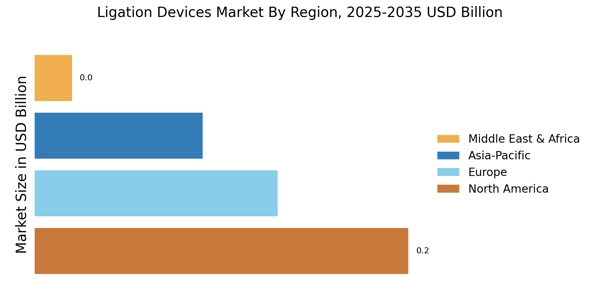

- Technological advancements are enhancing the efficacy and safety of ligation devices, particularly in North America.

- The focus on minimally invasive techniques is driving the adoption of ligation devices, especially in the largest segment of minimally invasive surgery.

- Handheld instruments remain the largest segment in the ligation devices market, while accessories are emerging as the fastest-growing segment.

- Rising prevalence of chronic diseases and a surge in surgical procedures are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 0.44 (USD Billion) |

| 2035 Market Size | 0.7165 (USD Billion) |

| CAGR (2025 - 2035) | 4.53% |

Major Players

(US), Boston Scientific (US), Johnson & Johnson (US), Stryker (US), B. Braun Melsungen AG (DE), Cook Medical (US), Teleflex (US), Conmed Corporation (US), Olympus Corporation (JP)