Increasing Prevalence of Epilepsy

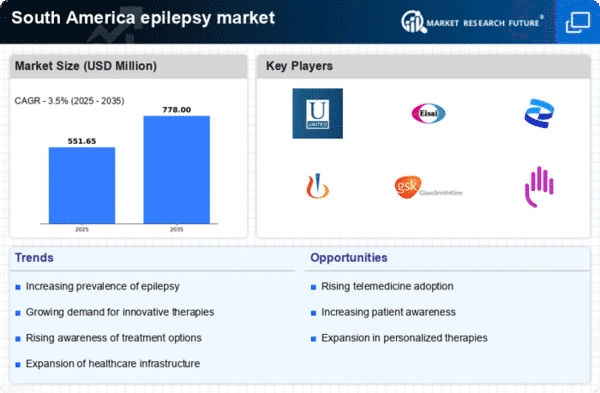

The rising prevalence of epilepsy in South America is a crucial driver for the epilepsy market. Recent estimates indicate that approximately 1.5 million individuals are affected by epilepsy in this region. This growing patient population necessitates enhanced healthcare services and treatment options, thereby stimulating market growth. The increasing number of diagnosed cases is likely to lead to a higher demand for antiepileptic drugs and other therapeutic interventions. Furthermore, the societal impact of epilepsy, including the stigma associated with the condition, drives the need for improved awareness and education initiatives. As healthcare systems adapt to these challenges, the epilepsy market is expected to expand significantly, reflecting the urgent need for effective management strategies.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare access and funding for epilepsy research are pivotal in shaping the epilepsy market in South America. Various countries in the region are implementing policies to enhance healthcare infrastructure and support research initiatives. For instance, increased funding for epilepsy research is expected to lead to the development of new treatment options and improved patient care. Additionally, public health campaigns aimed at raising awareness about epilepsy are likely to foster a more supportive environment for patients. This governmental support not only enhances the visibility of the condition but also encourages investment in the epilepsy market, potentially leading to a more robust healthcare ecosystem.

Growing Demand for Personalized Medicine

The shift towards personalized medicine is emerging as a significant driver in the epilepsy market. Patients are increasingly seeking tailored treatment options that consider their unique genetic and phenotypic profiles. This trend is particularly relevant in South America, where diverse genetic backgrounds may influence treatment efficacy. The market for personalized therapies is anticipated to grow, with estimates suggesting a CAGR of 10% over the next five years. As healthcare providers focus on individualized treatment plans, the epilepsy market is likely to witness a surge in demand for innovative therapies that cater to specific patient needs, thereby enhancing treatment outcomes.

Technological Innovations in Diagnostics

Technological advancements in diagnostic tools are transforming the epilepsy market in South America. Innovations such as portable EEG devices and advanced imaging techniques are enhancing the accuracy of epilepsy diagnosis. These technologies facilitate early detection and personalized treatment plans, which are essential for effective management of the condition. The market for diagnostic devices is projected to grow at a CAGR of around 8% over the next few years, driven by the increasing demand for precise and timely diagnosis. As healthcare providers adopt these innovations, the overall quality of care for epilepsy patients is likely to improve, further propelling the growth of the epilepsy market.

Rising Investment in Healthcare Infrastructure

Investment in healthcare infrastructure is a critical factor influencing the epilepsy market in South America. Many countries are prioritizing healthcare improvements, which include expanding access to epilepsy care and treatment facilities. This investment is expected to enhance the availability of specialized services for epilepsy patients, including comprehensive care centers and support networks. As healthcare systems evolve, the market for epilepsy treatments and services is likely to expand, driven by increased accessibility and improved patient outcomes. Furthermore, the establishment of new healthcare facilities may lead to a greater focus on research and development within the epilepsy market, fostering innovation and growth.