Investment in Healthcare Infrastructure

Investment in healthcare infrastructure across South America is positively impacting the embolic protection-devices market. Governments and private entities are increasingly allocating funds to enhance healthcare facilities, improve medical technology, and expand access to advanced medical treatments. This investment is likely to facilitate the adoption of embolic protection devices, as hospitals and clinics upgrade their equipment and procedures. For instance, Brazil and Argentina have seen substantial investments in healthcare, which may lead to improved surgical outcomes and increased utilization of embolic protection devices. As healthcare infrastructure continues to develop, the market is expected to benefit from enhanced availability and accessibility of these critical devices.

Technological Innovations in Medical Devices

Technological innovations in medical devices are significantly influencing the embolic protection-devices market in South America. Advances in materials, design, and functionality are leading to the development of more effective and user-friendly embolic protection devices. Innovations such as bioresorbable materials and improved delivery systems are enhancing the performance of these devices, making them more appealing to healthcare providers. As the market evolves, it is anticipated that these technological advancements will drive growth, with an expected increase in market size by approximately 15% over the next five years. The continuous evolution of technology in the medical field is likely to create new opportunities for the embolic protection-devices market, as healthcare professionals seek the latest solutions to improve patient outcomes.

Increasing Awareness of Cardiovascular Health

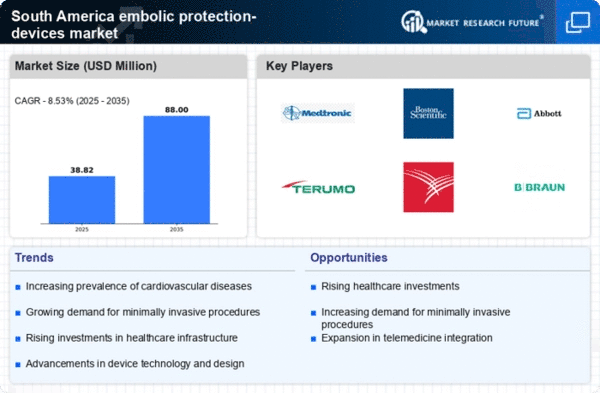

The growing awareness of cardiovascular health in South America is driving the embolic protection-devices market. Educational campaigns and health initiatives are emphasizing the importance of early detection and prevention of cardiovascular diseases. This heightened awareness is likely to lead to increased demand for embolic protection devices, as healthcare providers and patients seek effective solutions to mitigate risks during procedures such as angioplasty. The market is projected to grow at a CAGR of approximately 8% over the next five years, reflecting the rising focus on cardiovascular health. As more individuals become informed about the risks associated with cardiovascular conditions, the adoption of embolic protection devices is expected to rise, thereby enhancing the overall market landscape.

Rising Incidence of Stroke and Related Conditions

The rising incidence of stroke and related conditions in South America is a key driver for the embolic protection-devices market. Stroke remains one of the leading causes of morbidity and mortality in the region, prompting healthcare providers to seek effective preventive measures. The use of embolic protection devices during procedures such as carotid artery stenting is becoming increasingly common as a means to reduce the risk of stroke. Recent studies indicate that the incidence of stroke in South America is approximately 100 per 100,000 individuals, highlighting the urgent need for effective solutions. This growing concern is likely to propel the demand for embolic protection devices, as healthcare systems prioritize strategies to combat stroke and its complications.

Aging Population and Increased Surgical Procedures

The aging population in South America is contributing significantly to the embolic protection-devices market. As individuals age, the prevalence of cardiovascular diseases tends to increase, leading to a higher number of surgical interventions. This demographic shift is expected to result in a greater demand for embolic protection devices, as they play a crucial role in preventing complications during surgeries. According to recent statistics, the population aged 65 and older is projected to reach 12% by 2030 in South America, which may lead to an increase in surgical procedures requiring embolic protection. Consequently, the market is likely to expand as healthcare systems adapt to the needs of an older population, emphasizing the importance of these devices in surgical settings.