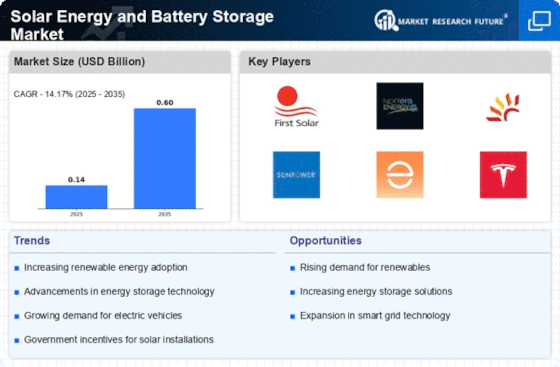

The Solar Energy and Battery Storage Market is currently characterized by a dynamic competitive landscape, driven by increasing demand for renewable energy solutions and advancements in technology. Key players such as First Solar (US), NextEra Energy (US), and Tesla (US) are strategically positioning themselves through innovation and regional expansion. First Solar (US) focuses on developing advanced thin-film solar technology, while NextEra Energy (US) emphasizes large-scale solar and wind projects, indicating a diversified approach to renewable energy. Tesla (US), on the other hand, integrates solar energy with battery storage solutions, enhancing its competitive edge in the energy ecosystem. Collectively, these strategies contribute to a robust competitive environment, where innovation and sustainability are paramount. In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance efficiency and reduce costs. The market appears moderately fragmented, with a mix of established players and emerging companies vying for market share. This competitive structure allows for a variety of approaches, as companies leverage their unique strengths to capture consumer interest and adapt to regional demands. In August 2025, First Solar (US) announced a significant expansion of its manufacturing capacity in the United States, aiming to produce more than 10 gigawatts of solar panels annually. This move is strategically important as it not only bolsters domestic production but also aligns with the growing trend of energy independence and local job creation. By increasing its manufacturing footprint, First Solar (US) positions itself to meet the surging demand for solar energy while mitigating supply chain vulnerabilities. In September 2025, NextEra Energy (US) unveiled plans to invest $5 billion in renewable energy projects over the next five years, focusing on solar and battery storage. This investment underscores the company's commitment to sustainability and its proactive approach to scaling operations in response to market demands. By prioritizing large-scale projects, NextEra Energy (US) aims to solidify its leadership position in the renewable energy sector, potentially influencing market dynamics significantly. In October 2025, Tesla (US) launched a new version of its solar roof tiles, which are designed to be more efficient and cost-effective. This innovation reflects Tesla's ongoing commitment to integrating cutting-edge technology into its product offerings. The introduction of enhanced solar roof tiles may not only attract new customers but also reinforce Tesla's reputation as a leader in the solar energy market, further differentiating it from competitors. As of October 2025, current competitive trends in the Solar Energy and Battery Storage Market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances among key players are shaping the landscape, fostering collaboration that enhances technological advancements and market reach. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technological prowess, and supply chain reliability, as companies strive to meet the growing expectations of environmentally conscious consumers.