Technological Innovations

Technological advancements play a pivotal role in shaping the Smart Ev Charger Market. Innovations such as wireless charging, fast charging capabilities, and smart grid integration are transforming the landscape of EV charging. The introduction of features like mobile app connectivity and real-time energy management systems enhances user convenience and efficiency. Furthermore, the development of ultra-fast chargers, capable of delivering significant power in a short time, is expected to drive market growth. As technology continues to evolve, the Smart Ev Charger Market is likely to witness increased investment in research and development, fostering a competitive environment that benefits consumers and manufacturers alike.

Rising Electric Vehicle Adoption

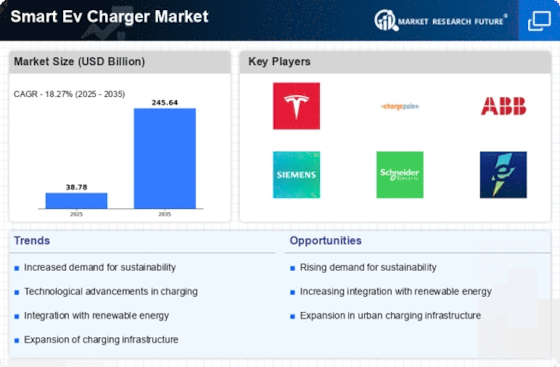

The Smart Ev Charger Market is experiencing a notable surge in demand, primarily driven by the increasing adoption of electric vehicles (EVs). As consumers become more environmentally conscious, the shift towards EVs is accelerating. According to recent data, the number of electric vehicles on the road is projected to reach over 30 million by 2025. This growing fleet necessitates a corresponding increase in charging infrastructure, particularly smart chargers that offer enhanced features such as remote monitoring and scheduling. The integration of smart technology into EV chargers not only improves user experience but also supports grid management, making it a critical component of the Smart Ev Charger Market.

Government Regulations and Policies

Government regulations and policies are increasingly influencing the Smart Ev Charger Market. Many countries are implementing stringent emissions targets and providing incentives for EV adoption, which in turn drives the demand for smart charging solutions. For instance, various governments are offering tax credits and rebates for the installation of EV chargers, making them more accessible to consumers. Additionally, regulations mandating the installation of charging infrastructure in new buildings are further propelling market growth. As these policies become more widespread, the Smart Ev Charger Market is expected to expand significantly, aligning with global sustainability goals.

Growing Investment in Charging Infrastructure

Investment in charging infrastructure is a critical driver of the Smart Ev Charger Market. As the number of electric vehicles continues to rise, the need for a robust and reliable charging network becomes increasingly apparent. Public and private sectors are recognizing this necessity, leading to substantial investments in the development of charging stations. Reports indicate that investments in EV charging infrastructure are projected to exceed 20 billion by 2025. This influx of capital not only enhances the availability of smart chargers but also encourages innovation within the market. Consequently, the Smart Ev Charger Market is poised for significant growth as infrastructure expands to meet consumer demand.

Consumer Demand for Convenience and Efficiency

Consumer preferences are shifting towards convenience and efficiency, significantly impacting the Smart Ev Charger Market. As electric vehicle ownership rises, users are seeking charging solutions that offer ease of use and time savings. Smart chargers equipped with features such as scheduling, remote access, and energy management are becoming increasingly popular. Data suggests that consumers are willing to pay a premium for chargers that provide enhanced functionality and integration with home energy systems. This trend indicates a growing market for smart charging solutions that cater to the evolving needs of consumers, thereby driving the Smart Ev Charger Market forward.