Technological Innovations

Technological innovations are transforming the Electric Vehicle AC Charger Market, leading to enhanced efficiency and user experience. Recent advancements in charging technology, such as smart charging solutions and integration with renewable energy sources, are becoming increasingly prevalent. These innovations not only improve charging speeds but also allow users to monitor and manage their charging sessions through mobile applications. In 2025, the market is witnessing a shift towards more sophisticated charging stations that offer features like real-time data analytics and energy management systems. Such developments are likely to attract more consumers to electric vehicles, thereby driving demand for AC chargers. The continuous evolution of technology in this sector suggests a promising future for the Electric Vehicle AC Charger Market.

Infrastructure Development

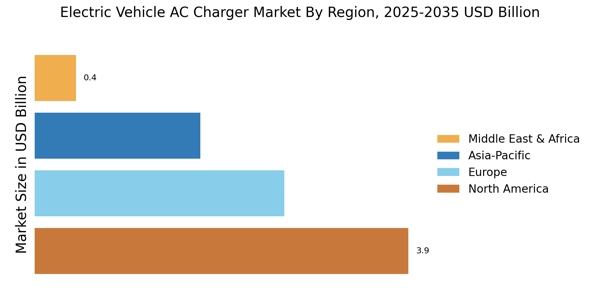

Infrastructure development is a crucial factor influencing the Electric Vehicle AC Charger Market. The expansion of charging networks is essential to support the growing number of electric vehicles on the road. In 2025, many regions are investing heavily in the installation of public charging stations, particularly in urban areas where demand is highest. This infrastructure growth not only enhances the convenience of owning an electric vehicle but also alleviates range anxiety among potential buyers. The Electric Vehicle AC Charger Market is likely to see increased collaboration between governments, private companies, and utility providers to create a comprehensive charging ecosystem. Such partnerships may lead to innovative solutions that further enhance the accessibility and reliability of charging infrastructure.

Consumer Awareness and Education

Consumer awareness and education are vital drivers of the Electric Vehicle AC Charger Market. As more individuals become informed about the benefits of electric vehicles and the associated charging technologies, the demand for AC chargers is expected to rise. Educational campaigns and outreach programs are being implemented to inform potential buyers about the advantages of electric vehicles, including lower operating costs and environmental benefits. In 2025, the market is likely to witness a surge in interest as consumers become more knowledgeable about charging options and the importance of having adequate charging infrastructure. This increased awareness may lead to higher adoption rates of electric vehicles, subsequently driving growth in the Electric Vehicle AC Charger Market.

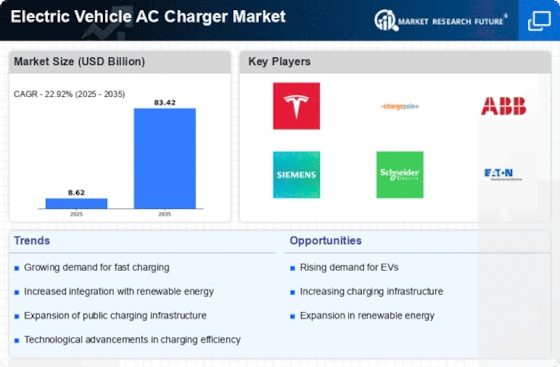

Rising Electric Vehicle Adoption

The increasing adoption of electric vehicles is a primary driver of the Electric Vehicle AC Charger Market. As consumers become more environmentally conscious, the demand for electric vehicles has surged, with sales projections indicating a potential doubling of electric vehicle registrations by 2026. This trend necessitates a corresponding expansion in charging infrastructure, particularly AC chargers, which are essential for home and public charging solutions. The Electric Vehicle AC Charger Market is thus positioned to benefit from this growing consumer base, as manufacturers and service providers strive to meet the rising demand for efficient and accessible charging options. The interplay between electric vehicle sales and charger availability is likely to create a symbiotic relationship that propels market growth.

Government Incentives and Policies

Government incentives and policies play a pivotal role in shaping the Electric Vehicle AC Charger Market. Various countries have implemented tax credits, rebates, and grants to encourage the adoption of electric vehicles and their associated charging infrastructure. For instance, in 2025, several regions have allocated substantial budgets to enhance charging networks, which is expected to increase the number of AC chargers significantly. These initiatives not only reduce the financial burden on consumers but also stimulate investments in the Electric Vehicle AC Charger Market, fostering innovation and competition among manufacturers. Furthermore, regulatory frameworks mandating the installation of charging stations in new developments are likely to create a more robust market environment, thereby enhancing accessibility and convenience for electric vehicle users.