Advancements in Battery Technology

Technological innovations in battery chemistry and design are significantly influencing the Lithium Battery Charger ICs Market. The emergence of new battery technologies, such as solid-state batteries and lithium-sulfur batteries, presents opportunities for enhanced performance and safety. As these technologies evolve, the corresponding charger ICs must adapt to accommodate different charging profiles and requirements. In 2025, the market for advanced battery technologies is projected to grow, potentially reaching 50 billion USD. This growth indicates a need for specialized lithium battery charger ICs that can efficiently manage the charging process, thereby driving innovation and competition within the industry.

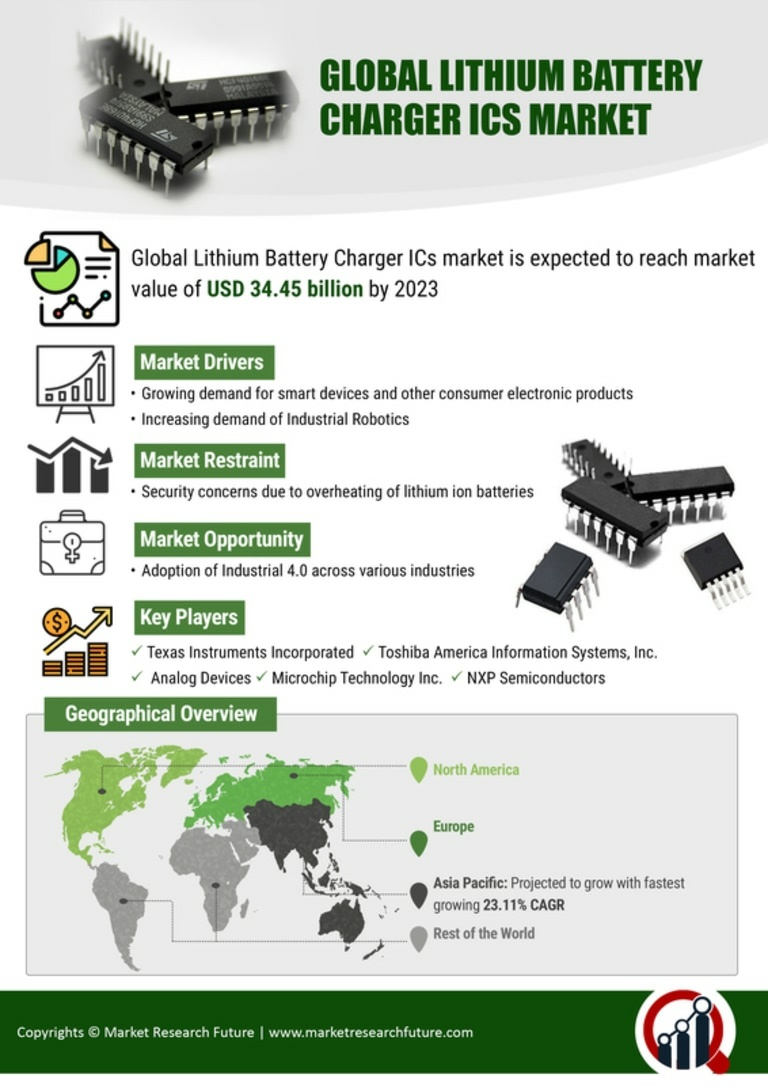

Consumer Electronics Proliferation

The relentless expansion of the consumer electronics sector is a vital driver for the Lithium Battery Charger ICs Market. With the proliferation of smartphones, tablets, and wearable devices, the demand for efficient and compact charging solutions is escalating. In 2025, the consumer electronics market is anticipated to surpass 1 trillion USD, with a substantial portion attributed to battery-operated devices. This trend necessitates the development of advanced lithium battery charger ICs that can cater to diverse charging requirements, including fast charging and multi-device compatibility. As manufacturers strive to meet consumer expectations for convenience and performance, the Lithium Battery Charger ICs Market is poised for robust growth.

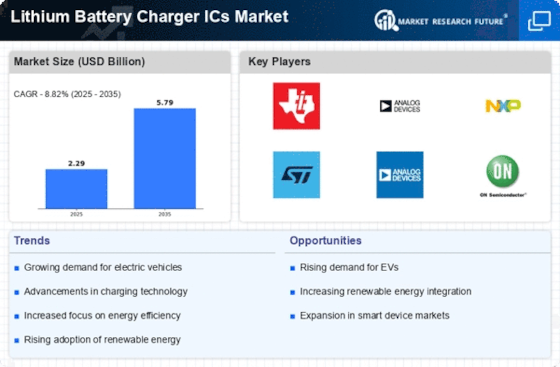

Rising Demand for Electric Vehicles

The increasing adoption of electric vehicles (EVs) is a primary driver for the Lithium Battery Charger ICs Market. As consumers and manufacturers shift towards sustainable transportation solutions, the need for efficient battery charging systems becomes paramount. In 2025, the EV market is projected to grow significantly, with estimates suggesting that over 30 million units will be sold annually. This surge in demand necessitates advanced lithium battery charger ICs that can support faster charging times and improved energy efficiency. Consequently, manufacturers are investing in innovative technologies to enhance the performance of these ICs, thereby driving growth in the Lithium Battery Charger ICs Market.

Regulatory Support for Energy Efficiency

Government regulations aimed at promoting energy efficiency and reducing carbon emissions are acting as a catalyst for the Lithium Battery Charger ICs Market. Policies encouraging the adoption of energy-efficient technologies are leading manufacturers to invest in advanced charger ICs that comply with stringent standards. In 2025, various regions are expected to implement more rigorous energy efficiency regulations, which could influence the design and functionality of lithium battery charger ICs. This regulatory environment not only fosters innovation but also creates a competitive landscape where companies must prioritize energy-efficient solutions, thereby propelling growth in the Lithium Battery Charger ICs Market.

Growth in Renewable Energy Storage Solutions

The transition towards renewable energy sources, such as solar and wind, is fostering the development of energy storage systems, which in turn propels the Lithium Battery Charger ICs Market. As more households and businesses adopt solar panels, the need for efficient battery management systems becomes critical. In 2025, the energy storage market is expected to reach a valuation of approximately 200 billion USD, with lithium-ion batteries playing a crucial role. This growth indicates a rising demand for specialized charger ICs that can optimize the charging process, enhance battery lifespan, and ensure safety. Thus, the integration of lithium battery charger ICs into renewable energy systems is likely to be a significant market driver.