Technological Advancements

Technological innovations play a crucial role in shaping the Global Slickline Services Market Industry. The introduction of advanced slickline tools and techniques enhances operational efficiency and safety, thereby attracting more investments. For instance, the integration of real-time data analytics and automation in slickline operations allows for better decision-making and reduced downtime. As these technologies evolve, they are expected to drive market expansion significantly. The anticipated growth trajectory indicates that by 2035, the market could reach 1278.6 USD Million, underscoring the importance of technology in meeting the demands of modern oil and gas operations.

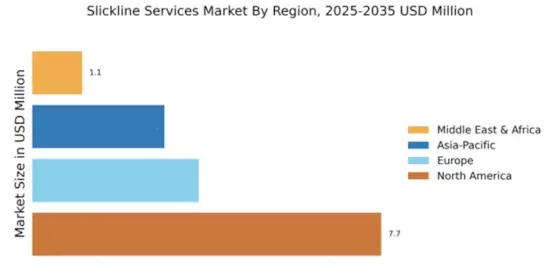

Market Charts and Projections

The Global Slickline Services Market Industry is characterized by various charts and projections that illustrate its growth trajectory. The market is anticipated to reach 628.8 USD Million in 2024, with further expansion expected to 1278.6 USD Million by 2035. The projected CAGR of 6.67% from 2025 to 2035 highlights the industry's resilience and adaptability in a changing economic landscape. These visual representations provide insights into market dynamics, investment trends, and the overall health of the slickline services sector, enabling stakeholders to make informed decisions.

Rising Exploration Activities

The Global Slickline Services Market Industry is significantly influenced by the rising exploration activities in both conventional and unconventional oil and gas reserves. As companies seek to tap into new resources, the demand for slickline services, which are vital for well intervention and maintenance, is expected to increase. This trend is particularly evident in regions with untapped potential, where exploration efforts are intensifying. The market's growth is indicative of the industry's response to these exploration demands, suggesting a robust future as companies invest in slickline capabilities to enhance production efficiency and reduce operational costs.

Increasing Demand for Oil and Gas

The Global Slickline Services Market Industry experiences a notable surge in demand driven by the increasing global consumption of oil and gas. As economies expand, the need for efficient extraction methods becomes paramount. Slickline services, which facilitate the maintenance and operation of wells, are essential for optimizing production. In 2024, the market is projected to reach 628.8 USD Million, reflecting the industry's response to this growing demand. The trend suggests that as exploration activities intensify, particularly in emerging markets, the reliance on slickline services will likely escalate, further propelling market growth.

Regulatory Support and Environmental Considerations

The Global Slickline Services Market Industry benefits from supportive regulatory frameworks aimed at promoting sustainable practices in oil and gas extraction. Governments worldwide are increasingly emphasizing environmental protection, leading to the adoption of slickline services that minimize ecological impact. Compliance with stringent regulations not only enhances operational safety but also boosts the market's appeal to environmentally conscious investors. As the industry adapts to these regulations, it is likely to witness a steady growth rate, with a projected CAGR of 6.67% from 2025 to 2035, reflecting the alignment of slickline services with global sustainability goals.