Research Methodology on Managed DNS Services Market

1. Introduction

Demand for managed DNS services has grown continuously over the years, a trend that is expected to further accelerate in the near future. The demand is primarily driven by the need to improve the speed and efficiency of organizational networks and to ensure reliability and assurance. To understand the dynamics of the managed DNS services market more deeply, it is important to employ a comprehensive research methodology that will take into account not only the existing market conditions and industry developments but also future market potential and growth trends. The research methodology for the market analysis and forecast of managed DNS services includes an in-depth market assessment of the current market size, emerging opportunities and trends, along with the identification, analysis and forecasting of various segments from 2023 to 2030.

2. Research Design

This comprehensive market research project adopts a comprehensive research design consisting of both qualitative as well as quantitative approaches. It is carried out by utilizing a rigorous and systematic process. The primary research methodology adopted involves market surveys, interviews and discussions with industry personnel and technology experts. The secondary research tools include collected data from existing market research papers, periodicals and proprietary databases.

3. Secondary Research

Before the research team initiates the primary research activities, the secondary research phase is carried out using a wide range of sources such as market news articles, industry reports, periodicals, regulatory announcements, trade journals, and other valid sources of information. Secondary research is conducted to bring in more exhaustive insights, and more accurate forecasts as well as validate and refine the primary research activities. The secondary research covers both demand-side and supply-side analysis.

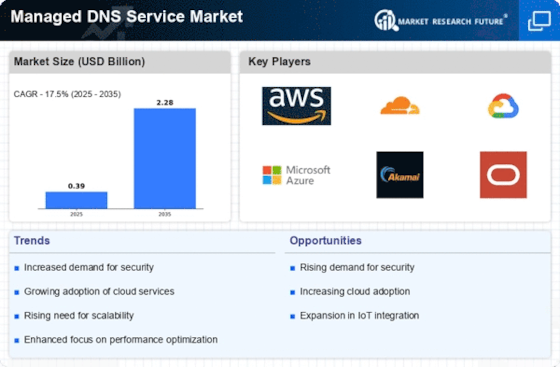

The demand-side analysis includes an assessment of market drivers, restraints, opportunities, challenges, and other factors influencing the market. It helps in identifying high-revenue and high-growth market segments. The supply-side analysis includes an assessment of various market players comprising their profile, market share, product portfolio and strategically deployed competitive intelligence.

4. Primary Research

Primary research is conducted to understand the market dynamics in greater detail and explore opportunities and challenges. The primary research is conducted by a team of experienced and knowledgeable industry experts, with data and feedback collected from key industry players and experts. The primary research activities involve interviews with the industry persons responsible for vendor selection decisions with respective companies and user organizations to get a complete understanding of their policies and practices. The secondary research is then compared and validated with the primary research. The primary research methodology encompasses interviews, surveys, focus group discussions, as well as workshops and one-to-one interactions with enterprise buyers, organizations and vendors.

5. Market Size Estimation

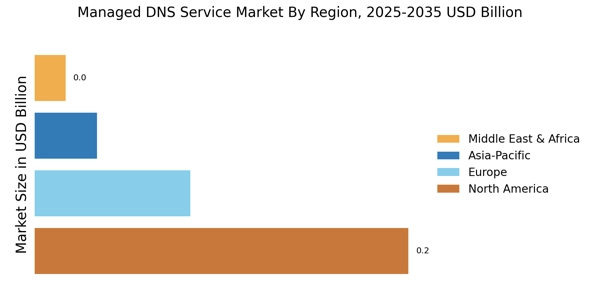

The market size estimation for the managed DNS services market is based on the comprehensive assessment of the market dynamics, detailed segmentation, and regional analysis. The regional analysis is conducted to understand the perspective of the market in various regions. The market size estimations are based on the top-down approach and the bottom-up approach.

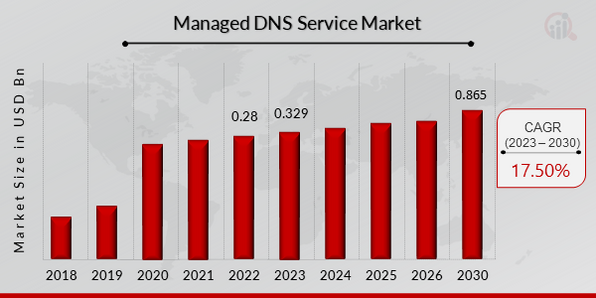

In the top-down approach, the market size is estimated based on the current market size and forecast from 2023 to 2030. This approach helps in understanding the general market trends and forecasts.

In the bottom-up approach, the market size is estimated based on the market growth rate, which is the summation of the unit prices of the product/service adjusted with the currency rate multiplications.

6. Data Triangulation

Data triangulation is conducted to validate and refine the market size estimations. It is conducted by studying the collected market data from multiple sources and then validating the market size anticipations by reconciling the market data.

Data triangulation is conducted both at the top-down approach and the bottom-up approach. In the top-down approach, the market size is estimated through the analysis of the current market size and changing dynamics of the market. In the bottom-up approach, the market size is estimated through an analysis of the unit prices of the products/services and the currency rate multiplications.

7. Modelling

Modelling is carried out to better understand and anticipate the future market size and trends. The modelling includes econometric modelling as well as forecasting models. Econometric modelling is conducted with the help of time-series data, hedonic models and regression techniques.

8. Assumptions

The market size estimations and forecasting activities are based on several assumptions, which may or may not be materialized. All assumptions are based on the inputs and subjective judgments of a variety of stakeholders such as industry experts, decision-makers, and government entities, who have a better understanding of the market dynamics and changing conditions.

9. Summary

The research methodology adopted for the analysis and forecast of the managed DNS services market is comprehensive, reliable and accurate. It is based on a market assessment of current and emerging market trends, segmentation, regional analysis, as well as primary and secondary research. The primary research is conducted by interviews and surveys with key industry personnel. The research methodology also includes market size estimation and modelling, which are conducted to better understand and forecast the future market size and trends. All assumptions made and approaches utilized for the market analysis and forecast of managed DNS services are based on sound rationale and reliable data sources.