Growing Focus on Sustainability

The increasing emphasis on sustainability is driving changes within the sintered steel market. Manufacturers are increasingly adopting eco-friendly practices, such as recycling and reducing waste during production. Sintered steel, known for its efficient use of raw materials, aligns well with these sustainability initiatives. In 2025, the market is expected to see a rise in demand for sintered steel products that meet environmental standards, potentially increasing market share by 20%. This shift towards sustainable practices not only enhances the reputation of manufacturers but also attracts environmentally conscious consumers, thereby expanding the customer base within the sintered steel market.

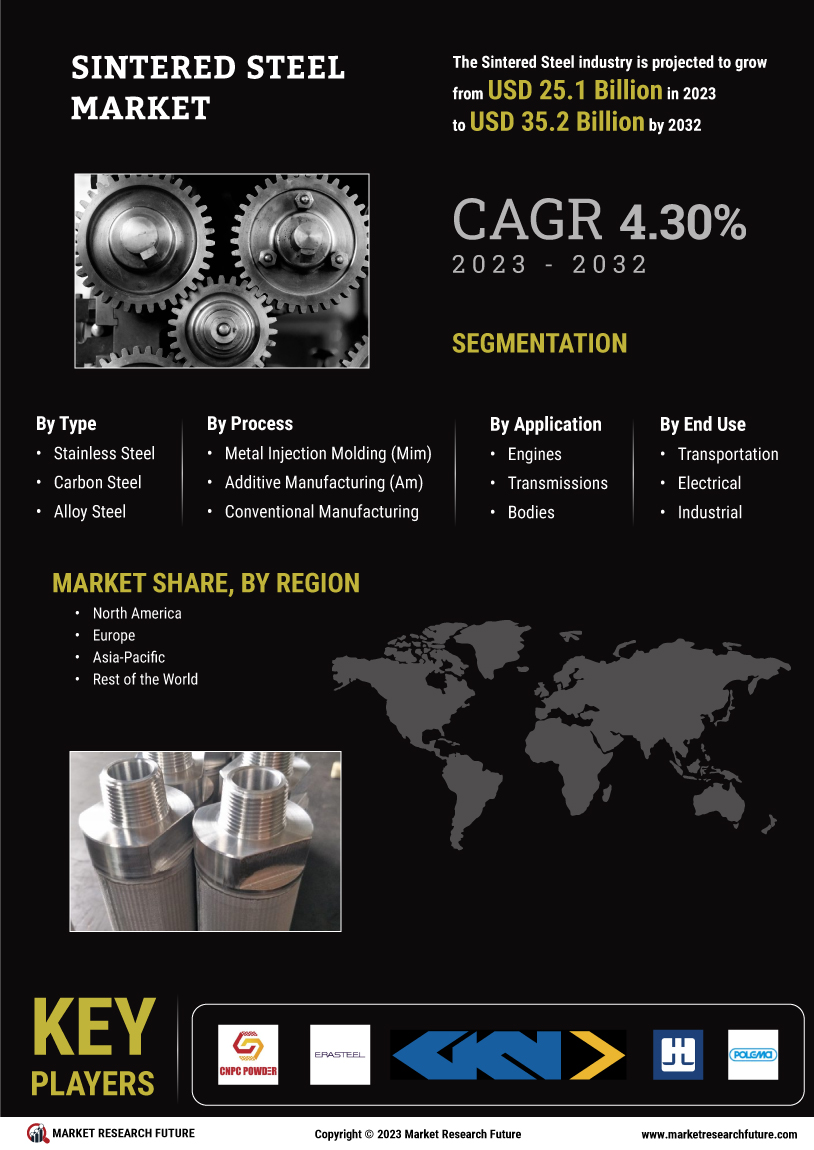

Rising Demand in Automotive Sector

The automotive sector is experiencing a notable increase in demand for sintered steel components, driven by the need for lightweight and durable materials. Sintered steel offers superior mechanical properties, making it an attractive choice for manufacturers aiming to enhance fuel efficiency and reduce emissions. In 2025, the automotive industry is projected to account for approximately 30% of the sintered steel market, reflecting a shift towards advanced manufacturing techniques. This trend is likely to continue as automakers increasingly adopt sintered steel for critical components such as gears, bearings, and structural parts. The sintered steel market is thus poised for growth, as automotive manufacturers seek innovative solutions to meet stringent regulatory standards and consumer expectations.

Expansion in Industrial Applications

The sintered steel market is witnessing an expansion in its application across various industrial sectors. Industries such as aerospace, construction, and machinery are increasingly utilizing sintered steel components due to their high strength-to-weight ratio and resistance to wear. This diversification is expected to contribute to a compound annual growth rate of approximately 10% in the sintered steel market by 2025. As industries seek to enhance performance and reduce operational costs, the versatility of sintered steel makes it a preferred choice for a wide range of applications, from structural components to precision tools.

Technological Innovations in Manufacturing

Technological advancements in manufacturing processes are significantly influencing the sintered steel market. Innovations such as additive manufacturing and advanced sintering techniques are enhancing the efficiency and precision of production. These technologies allow for the creation of complex geometries and improved material properties, which are essential for high-performance applications. In 2025, it is estimated that the adoption of these technologies will lead to a 15% increase in production capacity within the sintered steel market. As manufacturers strive to optimize their operations and reduce costs, the integration of cutting-edge technologies will likely play a crucial role in shaping the future landscape of the sintered steel market.

Increased Investment in Research and Development

Investment in research and development is playing a pivotal role in the evolution of the sintered steel market. Companies are allocating significant resources to explore new alloys and improve sintering techniques, which could lead to enhanced material properties and performance. In 2025, it is anticipated that R&D expenditures in the sintered steel market will increase by 25%, fostering innovation and competitiveness. This focus on R&D not only supports the development of advanced products but also positions manufacturers to respond effectively to changing market demands and technological advancements.